Dallas Home Prices and Mortgage Rates on the Rise

Dallas, Texas home prices are on the rise as the market transitions from a home buyer’s market into a home s eller’s market. With droves of new buyers and move up buyers looking for homes in the area, the market is showing serious signs of a lack of inventory. All the while, home loan rates have moved up to their highest levels in over a year. Is time running out to buy a home at record low home prices and interest rates?

eller’s market. With droves of new buyers and move up buyers looking for homes in the area, the market is showing serious signs of a lack of inventory. All the while, home loan rates have moved up to their highest levels in over a year. Is time running out to buy a home at record low home prices and interest rates?

Dallas home prices have risen just over 7% in the last year, according to the S&P Dow Jones Indices, and are projected to keep rising. Some particular Dallas areas like Lakewood, Canyon Creek, Prestonwood, and University Park have seen close to double digit growth in the first quarter of 2013 alone. Home prices aren’t the only thing on the rise though, since mid-April, home loan rates for an average 30-year mortgage have increased from around 3.3% to 4%, just in the last 45 days. Although mortgage rates are driven by many factors and market conditions, mortgage rates are expected to continue going up with more positive economic data and more money flowing into Stocks.

The economy as a whole has had a rough past few years, but has recently been showing serious signs of growth and improvement. This kind of positive economic outlook, combined with a growing real estate market, continue to paint a bright future of the U.S. economy and housing market, particularly in Dallas and surrounding markets. Job growth from local companies as well as many large corporations relocating their company offices and headquarters, have continued to flow into the Dallas area. The continued population and job growth in the area is ultimately causing housing prices to continue increasing as any new supply is taken away by the new buyers in the area.

With home loan rates and home prices on the rise, now may be the time you’ve been waiting for to sell your home and buy another. For many other who are deciding to stay in their home, this may be their last chance to refinance before interest rates go back up to 5% or higher. Regardless of the path for your real estate future, consider the Cost of Waiting to Buy.

If you would like to find out more information about homes in the Dallas, Texas area, as well as the surrounding suburbs like Richardson, Prestonwood, Lakewood, University Park and Highland Park, please don’t hesitate to call us directly at 972-499-0454. We’ve helped thousands of Dallas-area homeowners and home buyers navigate their home purchase or refinance and we’d love to assist you. Contact us today!

Mortgage Rate and Real Estate Update – Week of 12/03/12

No deal yet on the Fiscal Cliff and we know you’re getting tired of hearing about it. However, home ownership is a big part of the plan. Find out if home mortgage deductions are going away and how other news from the Fiscal Cliff talks will likely drive home loan interest rates for the coming weeks.

- Real Estate Investors – The $9.2 Billion Impact of 28.1 million U.S. Real Estate Investors

- How Fannie, Freddie, and Congress will use Home Mortgages to Fund Expanded Visa Program?

- Next Generation Buyers: Gen X and Gen Y Home Buyers are Savvy, Sophisticated and Ready to Buy

Mortgage interest rate and real estate news from last week:

Talks of the fiscal cliff issues continue to dominate the newswires and the mindsets of traders. The past week has seen mortgage backed securities hold strong near historic lows and above the 50 day moving average. The volatility picked up last Tuesday as progress was reported surrounding the fiscal cliff issues. The positive rumored news immediately helped Stocks rally over 200 points, taking the wind out of the sails of mortgage backed securities. This was just a glimpse of how big of an impact the fiscal cliff news will be going forward. The good news for home loan rates came when they were able to hold on to support at the 50 day-moving-average, proving this level to be a very strong floor of support and a benchmark worse-case scenario for the near-term.

What’s coming up this week on the economic calendar and what’s the impact on interest rates?

All eyes and ears will continue to be on news coming from the Fiscal Cliff talks. It’s all a matter of raising revenues and reducing costs, unfortunately for homeowners and prospective home buyers, eliminating the mortgage interest tax deduction would be a major source of tax revenue. If any changes are made to the tax deductions of mortgage interest, they are likely to be phased out over many years.

With the fiscal cliff talks ongoing, the economic calendar is full of employment and jobs data. Starting on Wednesday with the release of the ADP National Employment Report and rounding out with the Jobs Report on Friday, there is little ‘good’ news expected. Given the impact of storms on the East coast, there will likely be an increase in the Unemployment Rate and Initial jobless claims.

Here’s our strategy for the days and weeks ahead…

As home loan rates hover near historic lows and above support at the 25 and 50 day moving average, home loan rates are not expected to make a large move in either direction. As trading slows into the holiday season, any volatility that would drive home loan rates is likely to come from the fiscal cliff talks. We will recommend to cautiously float interest rates in the near term. However, should Congress find a resolution and back away from the cliff, expect the volatility to resurface at the possible expense of an increase in mortgage rates.

We maintain an ongoing dialogue with our clients about the market and interest rates throughout their financing experience so we can take advantage of the lowest rates when they present themselves. We all want the lowest rate, and the best way to ensure that you get the lowest rate, is to build a relationship with your mortgage planner, so they can best advise you on when to lock in your rate. Call us today for a complimentary mortgage review or Apply Online.

Mortgage Rate and Real Estate Update – Week of 11/26/12

It’s not a cyber Monday sale, home loan rates have actually been this low for a while now. Thanks to the fiscal cliff issues and Eurozone drama being front and center, interest rates are holding strong near historic lows.

Mortgage interest rate and real estate news from last week:

- Low mortgage rates allow buyers to afford up to 20% more in home price compared to 3 years ago

- The Fall and Rise of Jumbos – Homes values with jumbo mortgages fell hard, now rising Fast

- “G-Fees” drive up loan costs across the board for some states – Texas lucky to avoid this round, for now…

- Holiday tidbit – Wanting your own ’12 Days of Christmas’? The cost this year tops $107k

In a holiday shortened trading week, home loan interest rates and mortgage bonds were mostly unchanged. News that Europe is now in the midst of its second recession in four years and the U.S. weekly jobless claims coming it at their highest level in 18 months would typically spark more volatility, but interest rates seem to be comfortable in the current trading range established over the last month near historic lows. The low volume trading and friendly Bond news allows the Fed to keep their QE3 stimulus funds available for any major volatility that may come to the markets.

What’s coming up this week on the economic calendar and what’s the impact on interest rates?

With no major economic reports due for release this week, most attention will be placed on talks of a lawmakers reaching a resolution on the fiscal cliff issues. The markets will also be closely watching a meeting of finance ministers in the Eurozone as they digest news of the recession. The battle grows deeper as major Euro countries like Germany, refuse to participate in further “bail-outs” of Greece unless they can make further budget cuts and commit to repay some of their debt.

In the midst of the global economic soap opera, the Treasury will be auctioning off $99 Billion in Notes this week. Depending on the investor appetite of the 2, 5, and 7 year Note auctions, we could see volatility creep back into the Bond markets. On the flip side, should the auction go well, the S&P 500 could slip further from its 200 day moving average, allowing home loan rates to move closer to all time lows.

Here’s our strategy for the days and weeks ahead…

Interest rates for home loans have found a comfortable trading range over the last 30 days and have managed to create a solid level of support just beneath current levels. As long as mortgage Bonds can manage to remain above this key technical support, interest rates have a great chance to rally and move closer to all time lows for interest rates. Our advice would be to float in the near term unless something changes, causing pricing to break through support. With the amazingly low interest rates available to homeowners and home buyers, the time is now to consider their options for a refinance or start their planning for a home purchase.

We maintain an ongoing dialogue with our clients about the market and interest rates throughout their financing experience so we can take advantage of the lowest rates when they present themselves. We all want the lowest rate, and the best way to ensure that you get the lowest rate, is to build a relationship with your mortgage planner, so they can best advise you on when to lock in your rate. Call us today for a complimentary mortgage review or Apply Online.

Mortgage Rate and Real Estate Update – Week of 10/29/12

NYSE closed and Bond Markets closing early with Hurricane Sandy bearing down on the Northeast. Zillow launches its “Foreclosure Center” for prospective home buyers.

Mortgage interest rate and real estate news from last week:

- Zillow reports that U.S. home values saw their largest gain since 2006 with values jumping 1.3 percent in the third quarter

- Zillow launches its “Foreclosure Center” to give prospective home buyers access to pre-foreclosures, foreclosures and auctions in their area – http://www.zillow.com/foreclosures/

- Fed policy statement hints of continued slow growth with QE3 bond buying until the U.S. economy can support itself

- Third quarter GDP grew compared to the second quarter. Increased home buying helped fuel the growth

- Japan launches stimulus of $9.4 billion to increase growth and avoid “the risk of a Japanese fiscal cliff”

- Bank of America’s $4 billion purchase of Countrywide costs B of A more than $40 billion after write-downs, legal expenses, and settlements

What’s coming up this week on the economic calendar and what’s the impact on interest rates?

With the Bond Markets closing early on Monday in the wake of Hurricane Sandy, prices of mortgage backed securities opened higher but light trading is expected until the storm passes. SIFMA, who oversees the Bond markets, has announced that Bond markets will also be closed on Tuesday.

Core PCE was released upon market opening on Monday and showed a slight increase, a signal that inflation is starting to creep into the picture. However, the Fed still maintains a stance that inflation is not a concern. Halloween on Wednesday could prove to be a spooky trading day as investors hope to be back in action after a weather induced trading hiatus.

Weighing heavy on their trading direction will be the ADP Employment Report, Employment Cost Index and Chicago PMI, all scheduled for release on Wednesday morning. The reports continue on Thursday with Initial Jobless Claims and the national manufacturing index, ISM. ISM measures expansion or contraction in national manufacturing with a number over 50 signaling expansion and a number below 50 signaling contraction. The week closes with the Friday morning release of a highly anticipated Jobs Report. Having shown signs of growth and lower unemployment, more of the same is expected for the last Jobs Report before the election.

Here’s our strategy for the days and weeks ahead…

Bond prices and home loan rates won’t see much activity over the coming days, but we will be on guard when the markets reopen on Wednesday. With a heavy dose of Bond impacting news and shorter window to accomplish their Bond purchasing for the week, we could see home loan rates make an attempt to get back to their best levels ever. We will be watching the market reports closely throughout the week. Should pricing fall below current levels of support, we will recommend locking.

We maintain an ongoing dialogue with our clients about the market and interest rates throughout their financing experience so we can take advantage of the lowest rates when they present themselves. We all want the lowest rate, and the best way to ensure that you get the lowest rate, is to build a relationship with your mortgage planner, so they can best advise you on when to lock in your rate. Call us today for a complimentary mortgage review or Apply Online.

Current Mortgage Interest Rates – Week of 10/22/12

Mortgage interest rates increase by a quarter percent with selling pressure proving to be too much for Fed’s QE3 purchasing power. Nearly $100 billion in Treasury auctions, 3rd quarter GDP, and a FOMC meeting likely to make an impact on rates going forward.

What happened with mortgage interest rates last week?

Mortgage backed securities had one of their worst trading weeks in over 2 months, losing nearly 120 basis points before seeing a slight rebound on Friday. The selling pressure pushed mortgage bonds beneath support before finding resistance at the 50 day moving average. The move caused interest rates to increase by nearly .25%, providing another glimpseof how selling pressure can outweigh the Fed’s QE3 buying power.

The bond selling was largely influenced by economic releases and market news that began after the major inflation reading, Core CPI, was reported higher than expected. Not so great news for the first major inflation reading following the launch of QE3. Additionally, housing starts in September increased by 15% and Moody’s reported that they would maintain Spains debt rating. Positive economic news and higher than expected inflation is a recipe for Stock buying and Bond selling.

Further selling pressures are coming from an influx of new mortgage originations. As the low rates continue to increase home purchase loan and refinance activity, the added volume will continue to test the Fed’s QE3 purchasing power for months to come.

What’s coming up this week on the economic calendar and what’s the impact on interest rates?

The economic calendar is light this week with no major economic reports due other than a reading on third quarter Gross Domestic Product (GDP) on Friday. The biggest news of the week will come with the Fed’s monetary policy statement on Wednesday at 11:30 am CT. The statement will follow the two-day Federal Open Market Committee (FOMC) meeting. While there are no major changes expected to the Fed Funds Rate or the QE3 mortgage backed security purchase program of $40 billion per month, traders and investors will be analyzing the statement line by line to make notice of any changes.

Also on the radar this week will be the Treasury auction of $99 billion in two, five, and seven year Treasury notes. The added supply will give more options to investors and could sway purchasers away from mortgage Bonds until they establish further support on the 50 day moving average.

Here’s our strategy for the days and weeks ahead…

Following the large sell off in mortgage backed securities, Mortgage Bonds should technically hold on to current support at the 50 day moving average. For clients that were not able to lock in their rate last week before the market moved, we are recommending they float into the FOMC meeting, anticipating that pricing can rebound after being oversold. Should the market start to push Bonds below support, we will immediately shift to a Locking stance. The next level of support is over 100 basis points lower and would translate to higher interest rates.

We maintain an ongoing dialogue with our clients about the market and interest rates throughout their financing experience so we can take advantage of the lowest rates when they present themselves. We all want the lowest rate, and the best way to ensure that you get the lowest rate, is to build a relationship with your mortgage planner, so they can best advise you on when to lock in your rate. Call us today for a complimentary mortgage review or Apply Online.

Current Mortgage Interest Rates – Week of 10/15/12

Home loan rates stabilize in a new trading range after a 4 day sell off. Despite tame inflation and QE3 Bond buying, interest rates fail to recover back to historic lows. With a new trading trend emerging and a full week of economic releases, find out why you may need to lock in your interest rate before Friday.

What happened with mortgage interest rates last week?

Mortgage backed securities end the week roughly where it started, failing to break through resistance and re-establish a trading territory at the best levels for mortgage rates. After opening the week lower and dropping for the 4th day in a row, mortgage bonds found support at the 25 day moving average.

Weekly Initial Jobless Claims were reported at their lowest level since 2008. This encouraging news came after a report earlier this month that showed the Unemployment Rate dropped to its lowest level since early 2009. Both reports show promise for employment, but may be a brief blip on the radar amongst a trend of otherwise stagnant growth.

The Mortgage Bonds continued to trend higher on Friday morning after the Core PPI came in within the Fed’s target range. Core PPI is a wholesale inflation reading that will act as a barometer for the Fed and their ability continue stimulus and maintain a low rate environment.

It’s worth noting that Bonds have run out of steam the last 3 Fridays, causing rates to see a brief move higher. With the Fed only purchasing a set amount of Bonds per week, once those allotted funds are gone, the Bond trading will be handled without interference in the open market. When that’s happened to this point, Bonds have suffered.

What’s coming up this week on the economic calendar and what’s the impact on interest rates?

The economic calendar this week is packed with important data that could have an impact on Stocks and Bonds. The inflation readings will start with tomorrow’s (10/16) release of the Consumer Price Index (CPI). While the Core PPI released last week was tame, the CPI will be the first major inflation gauge since the Fed started into their QE3 printing/spending.

The economic reports continue on Wednesday with a projected increase in housing starts and building permits. While the reading may not have a large impact on Bond prices, the reports are worth noting as we move further into the week. Thursday will feature the release of more labor data with Initial Jobless Claims at 7:30 CT. Most attention from bond traders will be placed on the Philly Fed Index at 9am CT. The manufacturing report can have an impact on Stocks and Bonds as it helps forecast the upcoming release of the ISM Index.

Here’s our strategy for the days and weeks ahead…

With Bonds trading near support at the 25 day moving average, we are recommending our clients carefully float the market. The support can help provide a worst-case-scenario with an opportunity to lock in the rate if pricing breaks through the resistance level. However, Bonds are still trading near historic lows and the Fed has yet to show that their QE3 purchasing power has the ability to drive rates much lower. Given that rates have suffered at the end of the last 3 weeks, our sentiment may shift towards a locking bias if Bonds fail to make any substantial move in our favor.

We maintain an ongoing dialogue with our clients about the market and interest rates throughout their financing experience so we can take advantage of the lowest rates when they present themselves. We all want the lowest rate, and the best way to ensure that you get the lowest rate, is to build a relationship with your mortgage planner, so they can best advise you on when to lock in your rate. Call us today for a complimentary mortgage review or Apply Online.

Current Interest Rates – Week of 10/1/12

Stocks suffer their worst weekly loss in over a year. Home loan interest rates reach their lowest levels ever, but where can they go from here?

What happened with interest rates last week?

The stock market finally ran out of steam last week as the worst weekly loss since last June was handed to investors. Fortunately for home buyers and someone thinking about refinancing, as stocks are sold, investors will often shift their money to mortgage bonds and drive our mortgage rates lower.

Mortgage backed securities put on quite a show as they rocketed to new historic highs as the expense of the stock sell-off. The rally did fizzle as the week came to an end. In part due to a research report from Nomura Research, indicating that now is a time to take profits in Mortgage Bonds and adopt a more neutral stance. If this advise is followed, the mortgage bonds will lose in price with the investor profit-taking, driving home loan rates higher.

The disconnect between the state of our economy and stock prices has continued to grow. In large part due to a varying difference in philosophies between our government and business owners. Many major corporations have spent the last few years cutting back expenses in an attempt to sustain during the times of recession and economic uncertainty. The fears of slowing growth and lack of conviction in a political direction have made companies reluctant to grow and hire new employees. The end result is companies effectively managing their cash flow and creating a surplus of cash, allowing the payment of dividends and the hope of minimized downside risk. On the other hand, our economy and government as a whole (both parties), are continuing in a direction of increased spending through economic stimulus, and employment growth through government jobs. The end result here is yet to be seen, but the deficit continues to climb and massive amounts of cash only seem to appear in the form of stimulus. Which philosophy do you think is working?

What’s coming up this week on the economic calendar and what’s the impact on interest rates?

The economic calendar is light this week leading up to the Non-farm payrolls report on Friday. The majority of pressure on mortgage bonds and home loan rates will stem from reactions to Fed news and commentary throughout the week. Wednesday will feature the release of the FOMC Minutes. We already know that QE3 was the main topic in the last meeting, but the minutes could highlight some key points and opinions from the Fed members. Particularly after Charles Plosser, President of the Federal Reserve Bank of Philadelphia, said he doesn’t think that QE3 will be effective and that competing philosophies are dividing the Fed members.

Investors in stocks and bond markets will also be monitoring political unrest in Europe as Spain and Greece digest new austerity measures that may spawn violent protests. Any unrest could be a catalyst for investors to seek the safe haven of our bonds.

Here’s our strategy for the days and weeks ahead…

With mortgage backed securities sitting at the best levels in history and mortgage interest rates extremely low, the Fed is achieving their goal. There’s little reason to think that home loan rates will move significantly lower.

In the near term, we would expect that home loan rates would trend higher before going lower. The Fed has their stimulus spending gun loaded to keep rates low, but as we started to see late last week, when supply starts hitting the market (bond sellers), there has to be a buyer on the other end (Fed) to keep the price from deteriorating. Once the supply outweighs the purchasing power, the bond prices will drop and rates will go up. To protect against this, we continue to recommend locking in rates at historic lows.

We maintain an ongoing dialogue with our clients about the market and interest rates throughout their financing experience so we can take advantage of the lowest rates when they present themselves. We all want the lowest rate, and the best way to ensure that you get the lowest rate, is to build a relationship with your mortgage planner, so they can best advise you on when to lock in your rate. Call us today for a complimentary mortgage review or Apply Online.

Current Interest Rates – Week of 9/17/12

The Fed launches into QE3 in a big way, targeting the purchase of $40 billion in Mortgage Backed Securities per month in an attempt to keep mortgage rates low and further stimulate the economy. Mortgage backed securities hit all time lows, but the news isn’t all good for home loan rates and the long term health of our economy.

What happened with interest rates last week?

The FOMC held their meeting last week and came to a majority decision that further stimulus was needed to help stimulate the economy. A topic of conversation for months, QE3 was launched targeting the purchase of $40 billion worth of Mortgage Backed Securities per month in an effort to “put downward pressure on longer-term interest rates, support mortgage markets and help to make broader financial conditions more accommodative.” On top of that, the Fed announced an extension of previous stimulus “Operation Twist”, which will push an extra $25 billion per month into the long term securities.

In the past, the FOMC has typically stated a term of how long the stimulus will continue. In this case the buying is open-ended, stating “the Committee will continue its purchase of agency mortgage-backed securities, undertake additional asset purchases, and employ its other policy tools as appropriate until such improvement is achieved in a context of price stability.” These actions may continue to keep rates low for the near term, but this money printing to manipulate our markets could have huge implications on the long term value of our dollar.

We’re not alone. The ECB announced their planned asset purchases of its suffering EU members two weeks ago. The concept is noble, the results are yet to be seen. One of two things will happen. Either the massive money printing and spending by global banks will cause a massive spike in inflation (which increases home loan rates), or the efforts to stimulate the economies will start to work by resulting in economic growth at a level that can sustain some sort of repayment of the accumulated stimulus debt.

Either way you look at it, the long term outlook for someone other than the Fed to purchase Mortgage Bonds for a return on investment is looking less attractive by the day. With mortgage rates and securities in the 3%-4% range, the added risk and inflationary pressure of QE3, investors may start looking elsewhere for a safe place to park their money.

What’s coming up this week on the economic calendar and what’s the impact on interest rates?

The launch of QE3 in such a massive scale and without a designated end date has set the stage for other central banks around the globe to consider doing some money printing of their own. Why not? The U.S. is doing it. If our open-ended QE3 sparks more global stimulus, the risk of inflation becomes even greater. Commodities like gold, oil, silver, etc. have already started to price in the long term inflation risks and will only continue to do so. Remember that inflation lowers the value of our dollar, providing less purchase power for our goods and services. This also applies to long term interest rates. Investors earned dollars are worth less, so they start requiring a higher rate of return and/or interest rate.

The economic calendar is light this week with the release of the Empire State Index this morning at its worst levels since 2009. The Philly Fed Index will be released on Thursday at 9 am CT and could create a catalyst for mortgage rates to move. The Philly Fed Index provides insight into manufacturing activites while also giving a sample of what may be reported in the ISM Index release.

Here’s our strategy for the days and weeks ahead…

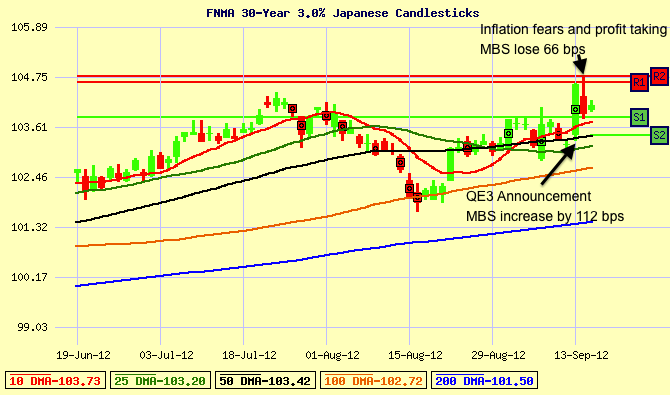

Home loan rates are lower as a result of QE3 being launched, but we feel like this may be as good as it gets for a while. When stimulus packages have been announced in the past, we have seen rates get better immediately following the announcements but saw steep rate increases in the weeks and months following. QE3 appears to be no different at the moment. Mortgage backed securities got to their best levels in history on the day of the announcement last Thursday. The following day saw a selloff of 66 basis points, driving interest rates back up by nearly .25%.

Home loan interest rates will continue to see volatility as global investors position themselves for a safe long-term investment. As the Fed adds another few hundred Billion to the balance sheet at a minimum, global investors may start to question how “safe” our long-term securities will be in the long run.

We maintain an ongoing dialogue with our clients about the market and interest rates throughout their financing experience so we can take advantage of the lowest rates when they present themselves. We all want the lowest rate, and the best way to ensure that you get the lowest rate, is to build a relationship with your mortgage planner, so they can best advise you on when to lock in your rate. Call us today for a complimentary mortgage review or Apply Online.

Current Mortgage Interest Rates – Week of 9/10/12

A roller coaster ride leaves interest rates at their best levels in over a month. A disappointing jobs report may be the final straw for the Fed to officially announce QE3 in their meeting this week. Find out how this impacts home loan interest rates.

What happened with interest rates last week?

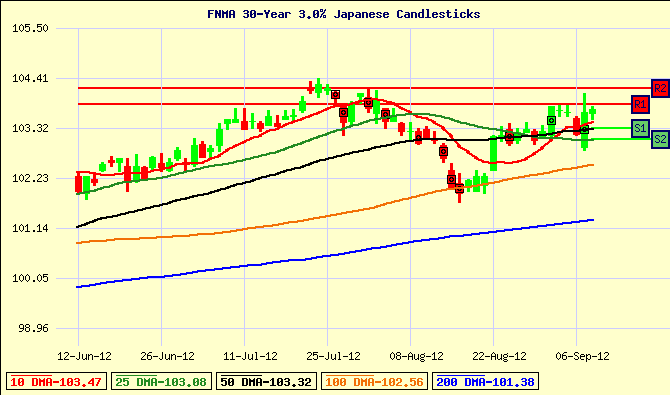

Interest rates in mortgage backed securities were on a wild ride last week and ended the week at the best levels in over a month. The majority of the volatility last week started with the ADP Employment report on Thursday. This report came in better than expected, sending stocks to multi-year highs and sent our mortgage backed securities beneath support at the 50 day moving average. While the ADP report is more of a picture of the private employment sector, the markets will often use this report as a glimpse of what may be to come in the Jobs Report that was released on Friday.

And for the Jobs Report? It was awful. Friday’s report was expected to announce 130,000 jobs created in August and the actual number was 96k. These large miss is a bad signal for the economy as a whole, which tends to drive investors into the safe haven of bonds like Mortgage Backed Securities (MBS). The result, MBS rallied as much as 120 basis points before closing up 75 bps. The big swing in price helps create a new trading range between the 50 day moving average and our recent highs set back in early August, roughly .125-.25% better than where we started the week.

What’s coming up this week on the economic calendar and what’s the impact on interest rates?

The markets could be quiet to start the week with no major announcements scheduled until Thursday with the minutes from the Fed Meeting (FOMC). As the meeting commences there will be $66 billion in Notes and Bonds auctioned this week. The auctions could provide some pressure on home loan interest rates and mortgage backed securities, but the markets around the globe will be waiting to see how the Fed responds to the disappointing jobs report and our current state of the economy.

The Fed has been hinting at the possibility of launching further economic stimulus, QE3, but has yet to make it official. However, top investment firms and analysts have placed a 50% chance that QE3 is announced this week. Many traders and investors have also seen this coming and have already started to factor in to stocks and bonds.

The question becomes, what impact does QE3 have on home mortgage rates, stocks, and other commodities? Even though QE3 is expected to target mortgage bonds to try and “stimulate” the economy, the spending increases our stimulus balance into the Trillions and is nothing but bad news for the US Dollar. We highlighted the potential impact of QE3 in our market update for the week of 6/4/12 and showed how Bonds have reacted to previous QE announcements. Each stimulus announcement, has seen a steep bond sell-off, causing our mortgage rates to go higher along with other commodities like Gold, Silver, Oil, etc. More printing/spending leads to our dollar becoming less valuable, requiring more dollars to purchase the same products, otherwise known as Inflation. Same goes for bonds and their interest rates. While the news is likely to be about how mortgage rates are being targeted to go lower, understand that inflation risk and low interest rates don’t mix.

Here’s our strategy for the days and weeks ahead…

The Jobs Report on Friday has more or less predestined the Fed to launch into further stimulus by way of QE3. Even though mortgage bonds are likely to be the target, we expect to see home loan interest rates go higher following the news. The markets will often take the stimulus news as a good sign immediately following the announcement, but the fact that it’s already been priced into the market and is a potential long term inflation risk, be prepared to lock in your interest rate after the news. In the mean time, we will be floating into the release of the Fed minutes on Thursday. Higher or lower, there is bound to be quite a bit of volatility this week allowing great opportunity for home buyers and home owners.

We maintain an ongoing dialogue with our clients about the market and interest rates throughout their financing experience so we can take advantage of the lowest rates when they present themselves. We all want the lowest rate, and the best way to ensure that you get the lowest rate, is to build a relationship with your mortgage planner, so they can best advise you on when to lock in your rate. Call us today for a complimentary mortgage review or Apply Online.

Current Interest Rates – Week of 9/4/12

Bernanke and the Fed are ready to launch QE3, targeting longer term securities. While this may help keep rates low, find out how increases to the “g-fee” charged by Fannie/Freddie will increase costs for consumers across the board.

What happened with interest rates last week?

Mortgage backed securities and interest rates finally broke out their tight trading range and are attempting to make a run towards historic low interest rates. Bernanke’s speech on the Economic Outlook and Monetary Policy in Jackson Hole, Wyoming was watched around the globe to see how the Fed may try to stimulate the economy. While further easing through QE3 was mentioned, it was yet to be announced. Nonetheless, even a mention caused stocks, bonds, gold, and oil to rally based on the strong likelihood that QE3 will be announced. It may come in the next Fed meeting held September 12-13th or they could continue to hold off. The purpose of QE3 is to stimulate the markets and just a rumor has already allowed them to accomplish their goal. Granted, it may not last long, but it allows the Fed more time to keep QE3 in their bag of tricks to stimulate the markets when the time is right. The market closed heading into the holiday weekend with a rally of over 50 basis points on Friday, closing at the best levels in over a month.

Other big news last week came from Fannie Mae and Freddie Mac as they begin to implement higher “g-fees” or guarantee fees on all of their loans. What’s a “g-fee”? Starting last year, Fannie and Freddie started to impose fees on all of their loans as a way to start to privatize some of the capital that backs their loans. Fannie/Freddie are largely backed by government capital through the Federal Housing Finance Agency (FHFA). Acting director, Edward Demarco said “These changes will move Fannie Mae and Freddie Mac pricing closer to the level one might expect to see if mortgage credit rrisk was borne solely by private capital.” Noble goal, but the “g-fees” are assessed to all Fannie/Freddie loans and will ultimately be incurred by our homeowners and we are far from seeing FHFA be replaced by private capital.

The key points to take from last weeks announcements are that even though the fundamental Bonds/securities that drive interest rates may be manipulated through Fed stimulus (QE3), there are other factors at play (g-fees) that are increasing the costs for home owners applying for a new mortgage loan. If rates decrease but costs increase, where does that put us? Possibly right where we started.

What’s coming up this week on the economic calendar and what’s the impact on interest rates?

The ISM Manufacturing Index was released this morning at the worst levels in over 3 years. The results have caused stocks to open the week lower and allowed Bonds and Mortgage Backed Securities to hold on to Friday’s gains.

On Thursday, the European Central Bank (ECB) is scheduled to deliver their rate policy going forward and will also discuss a rumored Bond buying program. The program would allow the ECB to purchase Bonds and help alleviate some of the risk of Bonds of the suffering countries. *Lookout ECB, we’ve tried this here. Please see paragraph above about FHFA and Fannie/Freddie.*

The big news this week comes with Friday’s Jobs Report. A signal for all markets, the Jobs Report can be a catalyst for big moves in stocks and Bonds. Thursday’s ADP Employment Report will provide some insight into what may be in store for the Jobs Report. Good Jobs numbers, look for stocks and the S&P to rally towards their multi-year highs around $1420. Bad Jobs numbers, stocks will suffer a further decline while mortgage backed securities and interest rates set the stage for another run at historic levels.

Here’s our strategy for the days and weeks ahead…

Bernanke’s speech in Jackson Hole on Friday brought a nice boost to mortgage backed securities and interest rates. We are currently recommended that our client closing in the coming days-weeks lock in their rate to secure the recent savings. We will be watching the news out of the ECB’s potential bond buying program. If this is seen to signal further risk for the economies in the EU, we could see our mortgage bonds become more of a safe haven, shifting our client strategy to float with the hope of lower rates to come leading into the Jobs Report. The market could see lots of volatility over the coming weeks and months. Be sure that you or your clients are in a relationship with a lender that understands and monitors the market closely.

We maintain an ongoing dialogue with our clients about the market and interest rates throughout their financing experience so we can take advantage of the lowest rates when they present themselves. We all want the lowest rate, and the best way to ensure that you get the lowest rate, is to build a relationship with your mortgage planner, so they can best advise you on when to lock in your rate. Call us today for a complimentary mortgage review or Apply Online.