Current Mortgage Interest Rates – Week of 9/10/12

A roller coaster ride leaves interest rates at their best levels in over a month. A disappointing jobs report may be the final straw for the Fed to officially announce QE3 in their meeting this week. Find out how this impacts home loan interest rates.

What happened with interest rates last week?

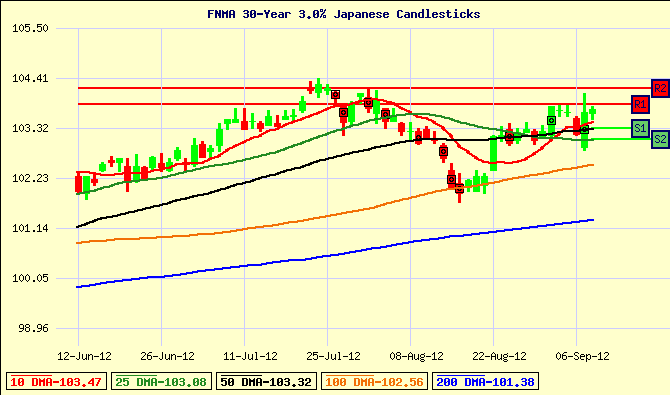

Interest rates in mortgage backed securities were on a wild ride last week and ended the week at the best levels in over a month. The majority of the volatility last week started with the ADP Employment report on Thursday. This report came in better than expected, sending stocks to multi-year highs and sent our mortgage backed securities beneath support at the 50 day moving average. While the ADP report is more of a picture of the private employment sector, the markets will often use this report as a glimpse of what may be to come in the Jobs Report that was released on Friday.

And for the Jobs Report? It was awful. Friday’s report was expected to announce 130,000 jobs created in August and the actual number was 96k. These large miss is a bad signal for the economy as a whole, which tends to drive investors into the safe haven of bonds like Mortgage Backed Securities (MBS). The result, MBS rallied as much as 120 basis points before closing up 75 bps. The big swing in price helps create a new trading range between the 50 day moving average and our recent highs set back in early August, roughly .125-.25% better than where we started the week.

What’s coming up this week on the economic calendar and what’s the impact on interest rates?

The markets could be quiet to start the week with no major announcements scheduled until Thursday with the minutes from the Fed Meeting (FOMC). As the meeting commences there will be $66 billion in Notes and Bonds auctioned this week. The auctions could provide some pressure on home loan interest rates and mortgage backed securities, but the markets around the globe will be waiting to see how the Fed responds to the disappointing jobs report and our current state of the economy.

The Fed has been hinting at the possibility of launching further economic stimulus, QE3, but has yet to make it official. However, top investment firms and analysts have placed a 50% chance that QE3 is announced this week. Many traders and investors have also seen this coming and have already started to factor in to stocks and bonds.

The question becomes, what impact does QE3 have on home mortgage rates, stocks, and other commodities? Even though QE3 is expected to target mortgage bonds to try and “stimulate” the economy, the spending increases our stimulus balance into the Trillions and is nothing but bad news for the US Dollar. We highlighted the potential impact of QE3 in our market update for the week of 6/4/12 and showed how Bonds have reacted to previous QE announcements. Each stimulus announcement, has seen a steep bond sell-off, causing our mortgage rates to go higher along with other commodities like Gold, Silver, Oil, etc. More printing/spending leads to our dollar becoming less valuable, requiring more dollars to purchase the same products, otherwise known as Inflation. Same goes for bonds and their interest rates. While the news is likely to be about how mortgage rates are being targeted to go lower, understand that inflation risk and low interest rates don’t mix.

Here’s our strategy for the days and weeks ahead…

The Jobs Report on Friday has more or less predestined the Fed to launch into further stimulus by way of QE3. Even though mortgage bonds are likely to be the target, we expect to see home loan interest rates go higher following the news. The markets will often take the stimulus news as a good sign immediately following the announcement, but the fact that it’s already been priced into the market and is a potential long term inflation risk, be prepared to lock in your interest rate after the news. In the mean time, we will be floating into the release of the Fed minutes on Thursday. Higher or lower, there is bound to be quite a bit of volatility this week allowing great opportunity for home buyers and home owners.

We maintain an ongoing dialogue with our clients about the market and interest rates throughout their financing experience so we can take advantage of the lowest rates when they present themselves. We all want the lowest rate, and the best way to ensure that you get the lowest rate, is to build a relationship with your mortgage planner, so they can best advise you on when to lock in your rate. Call us today for a complimentary mortgage review or Apply Online.