Current Interest Rates – Week of 9/17/12

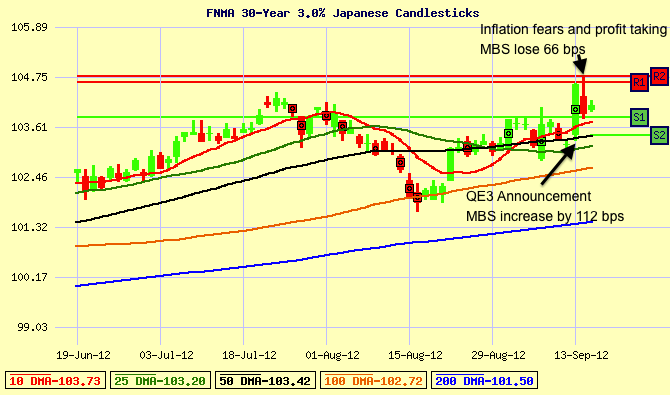

The Fed launches into QE3 in a big way, targeting the purchase of $40 billion in Mortgage Backed Securities per month in an attempt to keep mortgage rates low and further stimulate the economy. Mortgage backed securities hit all time lows, but the news isn’t all good for home loan rates and the long term health of our economy.

What happened with interest rates last week?

The FOMC held their meeting last week and came to a majority decision that further stimulus was needed to help stimulate the economy. A topic of conversation for months, QE3 was launched targeting the purchase of $40 billion worth of Mortgage Backed Securities per month in an effort to “put downward pressure on longer-term interest rates, support mortgage markets and help to make broader financial conditions more accommodative.” On top of that, the Fed announced an extension of previous stimulus “Operation Twist”, which will push an extra $25 billion per month into the long term securities.

In the past, the FOMC has typically stated a term of how long the stimulus will continue. In this case the buying is open-ended, stating “the Committee will continue its purchase of agency mortgage-backed securities, undertake additional asset purchases, and employ its other policy tools as appropriate until such improvement is achieved in a context of price stability.” These actions may continue to keep rates low for the near term, but this money printing to manipulate our markets could have huge implications on the long term value of our dollar.

We’re not alone. The ECB announced their planned asset purchases of its suffering EU members two weeks ago. The concept is noble, the results are yet to be seen. One of two things will happen. Either the massive money printing and spending by global banks will cause a massive spike in inflation (which increases home loan rates), or the efforts to stimulate the economies will start to work by resulting in economic growth at a level that can sustain some sort of repayment of the accumulated stimulus debt.

Either way you look at it, the long term outlook for someone other than the Fed to purchase Mortgage Bonds for a return on investment is looking less attractive by the day. With mortgage rates and securities in the 3%-4% range, the added risk and inflationary pressure of QE3, investors may start looking elsewhere for a safe place to park their money.

What’s coming up this week on the economic calendar and what’s the impact on interest rates?

The launch of QE3 in such a massive scale and without a designated end date has set the stage for other central banks around the globe to consider doing some money printing of their own. Why not? The U.S. is doing it. If our open-ended QE3 sparks more global stimulus, the risk of inflation becomes even greater. Commodities like gold, oil, silver, etc. have already started to price in the long term inflation risks and will only continue to do so. Remember that inflation lowers the value of our dollar, providing less purchase power for our goods and services. This also applies to long term interest rates. Investors earned dollars are worth less, so they start requiring a higher rate of return and/or interest rate.

The economic calendar is light this week with the release of the Empire State Index this morning at its worst levels since 2009. The Philly Fed Index will be released on Thursday at 9 am CT and could create a catalyst for mortgage rates to move. The Philly Fed Index provides insight into manufacturing activites while also giving a sample of what may be reported in the ISM Index release.

Here’s our strategy for the days and weeks ahead…

Home loan rates are lower as a result of QE3 being launched, but we feel like this may be as good as it gets for a while. When stimulus packages have been announced in the past, we have seen rates get better immediately following the announcements but saw steep rate increases in the weeks and months following. QE3 appears to be no different at the moment. Mortgage backed securities got to their best levels in history on the day of the announcement last Thursday. The following day saw a selloff of 66 basis points, driving interest rates back up by nearly .25%.

Home loan interest rates will continue to see volatility as global investors position themselves for a safe long-term investment. As the Fed adds another few hundred Billion to the balance sheet at a minimum, global investors may start to question how “safe” our long-term securities will be in the long run.

We maintain an ongoing dialogue with our clients about the market and interest rates throughout their financing experience so we can take advantage of the lowest rates when they present themselves. We all want the lowest rate, and the best way to ensure that you get the lowest rate, is to build a relationship with your mortgage planner, so they can best advise you on when to lock in your rate. Call us today for a complimentary mortgage review or Apply Online.