Current Interest Rates – Week of 8/27/12

Continued volatility brings interest rates and stocks from recent highs. Fed hints at purchase of Mortgage Backed Securities to further stimulate the economy. Is QE3 coming?

What happened with interest rates last week?

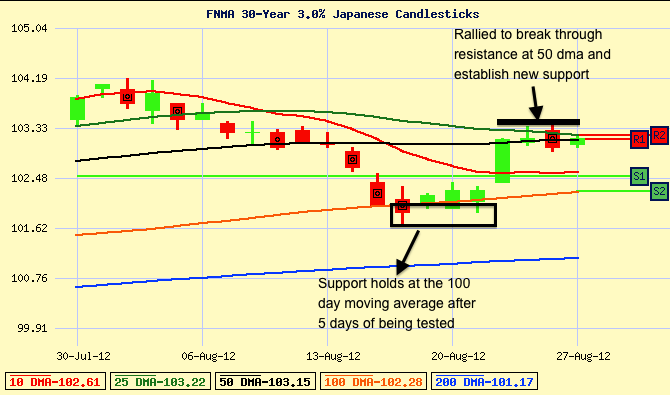

After weeks of steep selling in the Bond markets, yields for mortgage interest rates and the U.S. 10 yr. Treasury have risen anywhere between .25%-.375%. That’s a huge swing if you’re a home buyer out shopping with your Real Estate agent. With mortgage backed securities flirting with support at the worst levels since March (100 day moving average) and stocks fighting resistance at multi-year highs, something had to give. Mortgage backed securities and interest rates bounced off their worst levels and managed to erase half of their losses in one trading day, establishing new support at the 50 day moving average. At the same time, the 10 yr. Treasury peaked at its 200 day moving average before starting to pull back. These resistance levels will now begin to establish a new trading pattern.

What happened? The economic news was light last week, but most of the volatility came after the Fed released its FOMC minutes and further hinted at the need further stimulus. The commentary at this point hints at the purchase of Mortgage Backed Securities to try and help keep rates low or possibly drive them lower. While much of QE3 has been priced into the market for the last few months, a final release and confirmation of the purchase plan will likely bring more volatility to the markets.

Last week we showed how mortgage backed securities had fallen through support at the 50 day moving average (dma) and were trying to hold support at the 100 dma. After testing the support, mortgage backed securities rebounded to break above resistance and establish new ground at the 50 dma. This level will be watched closely to see if pricing can improve and bring us lower interest rates. (Remember that as the price of mortgage backed securities increase, the interest rates/yield will decrease).

What’s coming up this week on the economic calendar and what’s the impact on interest rates?

Most of the week will surround commentary, editorials, guesses, and opinions surrounding Fed Policy and direction. Does it make sense to take on further Fed stimulus by purchasing mortgage backed securities to boost the economy? The debate has been going on for years and the effects may linger for decades, but there is a strong likelihood that QE3 is coming. Fed Chairman Ben Bernanke will be delivering a speech on the Economic Outlook and Monetary Policy on Friday, possibly announcing QE3. If/When it happens, be prepared for massive market volatility.

The Bond markets will also battle a new $99 Billion in Treasury auction supply. As another long term, secure outlet for investors, these auctions can take away from buying of mortgage bonds but also acts as a litmus test for the Bond markets as a whole. $99B is a massive supply to unleash on the markets.

The economic calendar is full of reports this week but most should not have much of an impact on the Bond markets until Thursday’s Core PCE release. A popular measure of inflation, Core PCE should remain tame, but bonds and interest rates will almost always suffer if inflation starts to increase. File that away for now, but keep in mind for the coming months/years. Closing out the week will be the release of Chicago PMI, a manufacturing index to judge economic growth.

Here’s our strategy for the days and weeks ahead…

Interest rates have managed to find their way back to amazing levels and within a close range of historic lows. This rebound is a great opportunity for home seekers and home owners to think about locking in their interest rate. We’ve been shown again how volatile interest rates can be and see this rebound as an opportunity to capture what was lost. Sure, rates could move lower, but they could very easily move lower. Start a dialogue and relationship with someone that understands the market so you can take advantage of interest rate opportunities when they present themselves.

We maintain an ongoing dialogue with our clients about the market and interest rates throughout their financing experience so we can take advantage of the lowest rates when they present themselves. We all want the lowest rate, and the best way to ensure that you get the lowest rate, is to build a relationship with your mortgage planner, so they can best advise you on when to lock in your rate. Call us today for a complimentary mortgage review or Apply Online.

Current Interest Rates – Week of 8/20/12

Signs of some economic growth push mortgage interest rates and treasury yields higher. Technical indicators have helped us guide our clients to lock ahead of the big market swings. Make sure you understand what technical signals will be driving rates going forward.

What happened with interest rates last week?

Mortgage backed securities and interest rates started the week clinging to resistance at the 50 day moving average. This support level had been tested for three consecutive trading days as the mortgage bonds dipped down to and even below that level, but managed to hold support at those levels. While the support levels were tested, we changed our guidance to let clients know that any move below the 50 day moving average would trigger an alert to lock. Low and behold, Retail Sales were released on Tuesday morning showing the largest gain since February and the first gain in 4 months. Stocks rallied and mortgage backed securities started to plummet as the support line at the 50 day moving average was breached, causing the mortgage bonds to face a 3 day sell-off of over 100 basis points, rates going up near .25%.

While these technical signals help guide our approach to mortgage backed securities and interest rates, we can learn similar trends on the stock and equity side of the market that help us better predict what may be coming on the bond side. Amidst the blood bath in the mortgage backed security market, the S&P 500 has rallied but seems to be running out of steam at 4 year highs and a resistance level of around $1420. Having attempted to break through these levels on two previous occasions, the S&P 500 now shows the forming of a “Triple Top”. This means that since the S&P 500 has reached these levels twice previously and has yet managed to break through the resistance, a third failed attempt would further establish this ceiling of resistance and could drive stocks lower in a hurry. Any movement in this direction should allow for funds to flow back into our bonds and mortgage backed securities.

The new support level for mortgage backed securities that we will be watching closely is one established by the 100 day moving average. This support level has managed to hold since March of this year. Having been tested four straight trading days, the support of the 100 day moving average seems to be holding strong, hopefully placing a short term cap on the rising interest rates in this volatile market.

What’s coming up this week on the economic calendar and what’s the impact on interest rates?

On the back of last week’s report heavy calendar, all eyes and ears will be on the FOMC minutes scheduled to be released on Tuesday August 21st at 1 pm CT. As usual, the markets will be waiting to hear if there is any mention of further quantitative easing. The Fed has plenty of data to analyze and support further easing, but will likely hold off until, maybe after elections?

Fundamentally, there is not a whole lot out there to say that interest rates should climb much higher. The Euro Crisis continues to erode the finances of the European Union with the ECB still being rumored to step in and help “cap” Bond yields by taking on some of the debt load. While our US economy has shown some signs of growth, the major components still seem to be lacking much progress. All the while, a negative political climate is blanketing the airwaves, highlighting the apparent flaws in any of our candidates. The end result of this kind of environment would typically sustain and promote lower interest rates, but how low do we expect them to go?

Here’s our strategy for the days and weeks ahead…

Mortgage backed securities have been in the midst of one of the largest sell offs in years, which says a lot given what our economy has been through in the last 5 years. A simple reminder to show you that the markets can move in an instant, and a worthy incentive to our clients to be in a relationship with a mortgage planner or lender that can help guide you through the process. The support at the 100 day moving average has shown strength and should help keep our interest rates from going much lower in the near future. Clients that are closing in the coming days-weeks, we are still recommending that they lock in their interest rate to take advantage of improved pricing from the end of last week. Clients closing in the coming weeks and months, we recommend to cautiously float. The 100 dma has held strong but with time on our side, we would like to see if any of the lost ground can be made up. In the event pricing deteriorates and falls below the 100 day moving average, we will immediately be shifting to a locking position. Things could get ugly fast.

We maintain an ongoing dialogue with our clients about the market and interest rates throughout their financing experience so we can take advantage of the lowest rates when they present themselves. We all want the lowest rate, and the best way to ensure that you get the lowest rate, is to build a relationship with your mortgage planner, so they can best advise you on when to lock in your rate. Call us today for a complimentary mortgage review or Apply Online.

Current Interest Rates – Week of 8/6/12

In another volatile week, interest rates see highs and lows based on a mixed bag of economic reports and commentary. After breaking through key support levels and rates still near historic lows, we urge potential prospects and clients to start creating a strategy to take advantage of the big swings in their potential interest rate for their home loan.

What happened with interest rates last week?

After seeing one of the worst trading days in months on Friday 7/27, mortgage backed securities and interest rates made up most of their ground by the time the market closed on Monday 7/30. Showing a clear example of how volatile interest rates can be. The choppy trading continued throughout the week.

The major catalysts leading to these swings came from commentary out of last week’s Federal Reserve monetary policy statement. While the Fed said that the economic activity had slowed over the first half of 2012, there were not yet any announcements of further stimulus or QE3.

On Friday, the market opened with an expected 100,000 new jobs created by employers in July. The actual figure came in far better than expected at 163,000, while the Unemployment rate for people still filing/receiving unemployment assistance increased to 8.3%. Investors saw this as a ray of hope and helped push stocks higher while our mortgage backed securities and interest rates suffered, falling below a key level of support for the first time since March. Another reminder to be proactive with your home financing, whether purchasing or refinancing.

What’s coming up this week on the economic calendar and what’s the impact on interest rates?

After the rough trading day on Friday, mortgage bonds are trying to shake off some of the losses and stage a rally to open the trading week. After falling below the key support at the 25 day moving average, we will be watching to see if mortgage backed securities can close above the resistance level and start to establish a new trend towards historic lows.

There is not much economic data scheduled for release this week but investors will be watching to see how the Bond market handles an auction of $72 billion in auctions. This is where the market gets tested. Are our bonds still the safest haven for global investors looking to minimize risk? We’ll know by the end of the week.

Here’s our strategy for the days and weeks ahead…

Mortgage backed securities and interest rates have been extremely volatile over the last few weeks, showing glimpses of market uncertainty that we’ve faced throughout this financial crisis. With so many outside influences affecting the direction of interest rates, it is important to identify a trading range so we can have a better opportunity to secure the lowest interest rates when the opportunity arises.

Mortgage backed securities closing below the 25 day moving average for the first time since March could change the market sentiment and lead interest rates higher. Until bonds stabilize above this level, we will be recommending that our clients lock in their interest rates in the near and short term to take advantage of near historic lows. Should the market move to new historic lows after a rate lock, our team has the ability to renegotiate your interest rate with our lenders, providing a win win situation in this volatile and uncertain market.

We maintain an ongoing dialogue with our clients about the market and interest rates throughout their financing experience so we can take advantage of the lowest rates when they present themselves. We all want the lowest rate, and the best way to ensure that you get the lowest rate, is to build a relationship with your mortgage planner, so they can best advise you on when to lock in your rate. Call us today for a complimentary mortgage review or Apply Online.

Current Interest Rates – Week of 7/30/12

Interest rates move fast as fears subside in Europe, helping boost stocks. Mortgage backed securities move from all time highs to their worst levels in 3 weeks as investors sell bonds to free up cash and take advantage of the positive global economic outlook.

What happened with interest rates last week?

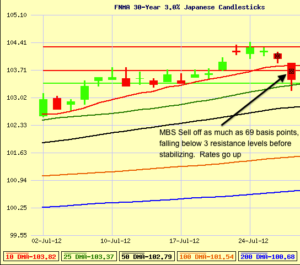

We started off last week’s report with interest rates at all time lows and the yield on the 10-Year Treasury Note at its lowest levels since the early 1800s, 1.39%. By the time the market closed on Friday, mortgage backed securities had reached their worst level in 3 weeks and the 10 yr. Yield had climbed to 1.54%. That is a massive swing in the market, with the majority of it coming in a 3-4 hour period on Friday.

Why the big swing? Before the market opened on Friday, rumors surfaced that the European Central Bank (ECB) would start buying debt of countries within the European Union (such as Italy, Spain, France…) to reduce the recent pressures on their yields/rates. We mentioned last week that the Spanish yield had climbed to 7.62%, but after investors factored in the potential purchasing of the ECB, the yield dropped down to 6.58%. The ECB purchasing these other bonds lets investors know that they’re not the only ones with skin in the game for the national debt of a country, thus driving down the required yield or required rate of return for the bonds of those countries being purchased.

The end result of this shift in market sentiment is for money to flow out of the safe haven of our US bonds (MBS, 10 yr. Treasury…) and into something that is paying a higher yield. This causes our mortgage backed securities to sell off, driving rates higher. The chart below will show the swing on Friday after the rumors were released.

When it comes down to it, investors can purchase a fixed rate of return from the US at a rate of 1.39% through a 10 yr. Treasury Note or they can go buy a fixed rate of return from the Spanish Treasury and get a 6.58% rate of return. It all comes down to investors having confidence that their yield will get paid and that there will be a market available to sell when the time is right. The spreads on these returns will normalize at some point, but in the mean time, look for investors to keep rolling the dice to find the sweet spot between a risk/reward relationship in bonds and treasuries.

What’s coming up this week on the economic calendar and what’s the impact on interest rates?

Following up a volatile trading week, mortgage backed securities and interest rates won’t have a chance to rest. The FOMC and ECB will be meeting this week with investors listening closely for any rumors and announcements. Since the FOMC and ECB have the ability to flex their muscle and announce how much firepower they’re willing to invest to help stabilize the markets, investors recognize this and will in many cases follow their direction. Rumors alone caused the market shift on Friday, so any news could be an important factor to help our clients secure the lowest interest rate.

Here’s our strategy for the days and weeks ahead…

As the 10-Yr. Note and mortgage backed securities took one of their largest hits in months, we are recommended that our clients closing in the coming days/weeks to lock in their interest rate now. We were fortunate to have our clients prepared for the market movement on Friday and were able to secure their interest rates before the market moved, savings them thousands of dollars over the life of their loan.

The opportunity to secure a historic low interest rate will come and go, so if you or your clients are closing in the coming weeks/months, we continue to recommend starting your pre-qualification process so that you can have a strategy in place for when interest rates make another run at historic lows. By beginning the process with your mortgage planner, they can be prepared to help you take advantage of these historic low mortgage rates next time the opportunity arises.

We maintain an ongoing dialogue with our clients about the market and interest rates throughout their financing experience so we can take advantage of the lowest rates when they present themselves. We all want the lowest rate, and the best way to ensure that you get the lowest rate, is to build a relationship with your mortgage planner, so they can best advise you on when to lock in your rate. Call us today for a complimentary mortgage review or Apply Online.

Current Interest Rates – Week of 7/9/12

Poor jobs report and bleak painting of future job growth lead home loan interest rates to all time lows. Sets the stage for best home buying and home refinance opportunities ever.

What happened with interest rates last week?

Interest rates moved a leg lower to set new all time lows for potential home buyers and homeowners. The Jobs Report was released last Friday showing that only 80,000 jobs were created in June, well below the 100,000 that were expected.

These gloomy reports, in combination with a stalling global economy, create uncertainty for stock and equity markets. The end result, money flows from those stocks and equities into the safe haven of bonds and mortgage backed securities, causing interest rates/yields to drop to record lows.

What’s coming up this week on the economic calendar and what’s the impact on interest rates?

Following the poor Jobs report here on the mainland, China and Japan released worse than expected economic data to start our trading week. While mortgage backed securities and bonds are trading at unprecedented levels, these lows could be affected by $66 billion in notes and bonds that will be auctioned this week.

The lackluster reports have also started to revive the talks of QE3 with the markets placing a 75% chance that further stimulus will be unveiled. Let the banter between Fed members begin and expect it to continue until the next Fed meeting in August.

Here’s our strategy for the days and weeks ahead…

Home loan interest rates continue to ride the wave of the US and global markets and as these markets continue to plunge, our home financing rates are doing the same. The advice to our clients closing in the days/weeks ahead would be to lock in your rate today, literally sitting at the best levels ever. Rates could continue to move lower, but our signals point to rates going back up to more “normal level” before they push lower in a longer time frame.

The chart below shows mortgage backed securities breaking through all previous resistance levels into historic and untested territory. With no real trading/technical data available at these levels, new resistance and support is being created daily/hourly. Resistance and support will become stronger as the levels are tested over time.

We maintain an ongoing dialogue with our clients about the market and interest rates throughout their financing experience so we can take advantage of the lowest rates when they present themselves. We all want the lowest rate, and the best way to ensure that you get the lowest rate, is to build a relationship with your mortgage planner, so they can best advise you on when to lock in your rate. Call us today for a complimentary mortgage review or Apply Online.

Current Interest Rates – Week of 6/25/12

Home loan interest rates, home affordability, and low inventory set the stage for homeowners and home buyers to save thousands. Whether refinancing, moving up, or financing your first home, now is the time to create your real estate strategy and put a plan in place.

What happened with interest rates last week?

The Fed held their quarterly meeting last Tuesday and Wednesday, with stimulus and the possibility of QE3 being announced. The result, extend the current stimulus program “Operation Twist”, allowing the possibility of QE3 in the future. Interest rates took cues from stocks as investors used the announcement as an opportunity to make a quick buck in stocks, causing a brief sell-off in mortgage backed securities, causing home loan rates to increase. Fortunately for interest rates, the stock rally was brief and home loan rates found their way back to levels where they opened the week, poised to make a run at setting/meeting historic lows.

What’s coming up this week on the economic calendar and what’s the impact on interest rates?

Following a week full of anticipated announcements from the Fed, the only scheduled economic reports due this week will be on Friday 6/29 with the release of Core PCE, a popular measure of inflation that excludes food and energy costs. The previous release was at 1.9%, within the Fed’s target range of 1.7-2.0%. While not expected, a release above the target range could cause interest rates to go up. The Chicago PMI, aka “Business Barometer” is also due for release on Friday. Signs of business growth would be good for stocks and bad for rates. Signs of slowing/stagnant business growth would be bad for stocks and good for the safe haven of bonds/interest rates.

The elephant in the room would be the pending release of the Supreme Court’s ruling on the the Affordable Health Care Act. While seemingly unrelated to interest rates or home purchase financing, the ruling will have a great impact on corporations down to small businesses as their plans for growth may be dependent on their required health care plans and/or contributions. With no set date/time for the release of the ruling, it is expected at the end of the week and could be a big factor in market movement once the news hits the wire.

Here’s our strategy for the days and weeks ahead…

Interest rates are trading in a tight range attempting to break out to test the historic lows reached on June 1st. Since mortgage backed securities have never closed above this level, it now acts as a ceiling of resistance that will likely take some sort of catalyst in the market to break through. The good news is, the catalyst could come from any of the following likely sources: further Euro meltdown, Supreme Court ruling on Affordable Healthcare Act, poor economic releases…

The key is to know where you stand with your current home financing in relation to what’s available in today’s low interest rate environment. While rates are likely to remain low, waiting a year to refinance at the same rate available today, would end up costing you thousands of dollars. On a similar note, if you’re buying a home in Dallas, the prices are likely to be higher next year, causing less affordability and the potential of a higher monthly payment than you would have today.

The bottom line is know where you stand in relation to where you would like to be, whether that’s in the same home with a lower payment or in the new home of your dreams. The opportunities available to homeowners are amazing.

We maintain an ongoing dialogue with our clients about the market and interest rates throughout their financing experience so we can take advantage of the lowest rates when they present themselves. We all want the lowest rate, and the best way to ensure that you get the lowest rate, is to build a relationship with your mortgage planner, so they can best advise you on when to lock in your rate. Call us today for a complimentary mortgage review or Apply Online.

Current Interest Rates – Week of 5/29/12

Food for thought…Interest rates were a staggering 1% higher at this time last year. Sure, sounds like a big swing, but what does this mean to someone in the market for a home loan? The current low interest rates allow someone looking in the $225k price range to afford an extra $25,000 in loan amount compared to a year ago. The same loan amount with a point higher rate would be over $133 more per month. While interest rates may not go up immediately, the chart below illustrates how quickly interest rates can move.

What happened with interest rates last week?

After reaching all time lows with interest rates on multiple occasions in weeks prior, interest rates were not able to push lower. Instead, we saw mortgage backed securities sell off and have started to make a pretty good case that rates are about as good as they’re going to get for the near term.

The eco-drama continues over in Europe with Spain trying to get a grip on their financials. It’s your choice on who to thank, but Spain, Greece and the rest of the European Union have, without question, helped move our interest rates to where they are and have kept them from going higher. Fear based selling drives money into longer term bonds, helping interest rates.

Markets closed early last Friday and were closed no Monday in observance of Memorial Day.

What’s coming up this week on the economic calendar and what’s the impact on interest rates?

Coming up during this holiday shortened week is the ADP Employment Report on Thursday 5/31 at 7:15 CT and Chicago PMI at 8:45 CT, both of which could cause interest rates to move.

Rounding out the week is one of the more action/news filled days we typically see on the calendar. This will be kicked off on Friday morning, starting at 7:30 CT prior to the market open. The first item worth highlighting is the release of Core PCE, a popular measure of inflation. The Fed likes to see this number within a target range of 2%. Should this figure come in higher than expected, interest rates could suffer due to fear of inflation, the arch nemesis of bonds/rates.

Perhaps the largest report of all is the Jobs Report, estimating non-farm payrolls to be at 155,000. A number reported higher than expected means a potential for rates to suffer as the warm and fuzzies of a growing economy fill the air and investors move their money out of bonds and into stocks.

Here’s our strategy for the days and weeks ahead…

Home mortgage interest rates have gone up over the last few weeks since reaching all time lows. Will interest rates get that low again? It wouldn’t be a surprise if they did, but based on the data and tools that we have on hand, interest rates are more likely to go up over the next year than they are to go lower. Take a look at the chart above and imagine the market moving the other direction, causing rates to increase over 1%. It’s not a matter of if they’ll go up, but when, so talk with your mortgage planner to put a plan in place to take advantage of these rates while they’re still around.

Current Interest Rates – Week of 5/21/12

What happened with interest rates last week?

Interest rates and mortgage backed securities met all time lows last week on 3 separate occasions. These historic levels have only been reached one other time, back on February 2, 2012, and have been fueled by the fears of a Greek euro exit, deteriorating health of the Spanish banking system, and the stock market’s steep sell-off. As the lows were reached with interest rates, the markets seem to have once again found this as a ceiling of resistance, meaning some sort of catalyst will likely be needed to break through the ceiling and avoid getting pushed back lower.

In the FOMC minutes released last week, several members noted “that additional monetary policy accommodation could be necessary if the economic recovery lost momentum”, however, “one participant noted the potential risks and costs associated with additional balance sheet actions.” The markets will be on standby to see how this unfolds in coming meetings.

What’s coming up this week on the economic calendar and what’s the impact on interest rates?

There is little news slated to come out this week that would have a major impact on rates. Investors will be taking cues from the headlines out of Europe and results from Treasury auctions. Facebook will act as a barometer for the other social media stocks as the Dow, Nasdaq and S&P look to rebound.

New homes sales figures are due on Wednesday at 9 am CT. Initial jobless claims and durable goods will be released on Thursday at 7:30 am. The week will close with Consumer sentiment at 8:55 am on Friday going into the holiday weekend.

Here’s our strategy for the days and weeks ahead…

It’s a great time to be buying or refinancing with interest rates at historic lows. Looking back at our previous attempt to break through these levels, we saw rates climb one half percent in 45 days, with some stretches moving .25% over a one or two day span. While we don’t see the catalyst for this to happen on the calendar, any positive news coming out of Europe or our equity markets will give investors a reason to make a quick buck by selling their bonds and buying stocks, causing interest rates to suffer. If you’re in a short time frame (less than 30 days), be ready to lock at a moment’s notice and make sure that your loan officer or mortgage planner has a strategy in place to lock in your rate as news unfolds.

The stock and bond markets will be closed on Monday for Memorial day. Next week’s market update will be released on Tuesday, May 29th.