Current Interest Rates – Week of 8/27/12

Continued volatility brings interest rates and stocks from recent highs. Fed hints at purchase of Mortgage Backed Securities to further stimulate the economy. Is QE3 coming?

What happened with interest rates last week?

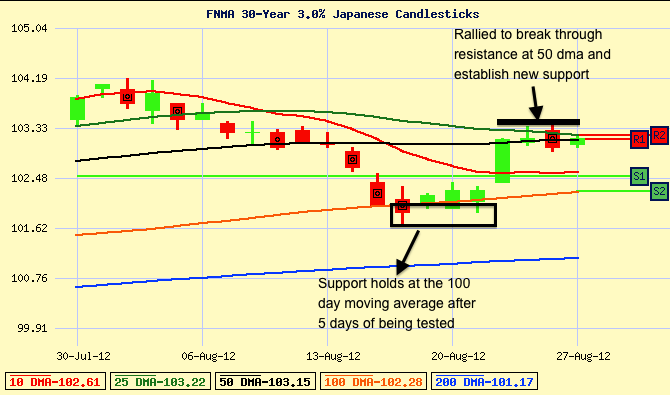

After weeks of steep selling in the Bond markets, yields for mortgage interest rates and the U.S. 10 yr. Treasury have risen anywhere between .25%-.375%. That’s a huge swing if you’re a home buyer out shopping with your Real Estate agent. With mortgage backed securities flirting with support at the worst levels since March (100 day moving average) and stocks fighting resistance at multi-year highs, something had to give. Mortgage backed securities and interest rates bounced off their worst levels and managed to erase half of their losses in one trading day, establishing new support at the 50 day moving average. At the same time, the 10 yr. Treasury peaked at its 200 day moving average before starting to pull back. These resistance levels will now begin to establish a new trading pattern.

What happened? The economic news was light last week, but most of the volatility came after the Fed released its FOMC minutes and further hinted at the need further stimulus. The commentary at this point hints at the purchase of Mortgage Backed Securities to try and help keep rates low or possibly drive them lower. While much of QE3 has been priced into the market for the last few months, a final release and confirmation of the purchase plan will likely bring more volatility to the markets.

Last week we showed how mortgage backed securities had fallen through support at the 50 day moving average (dma) and were trying to hold support at the 100 dma. After testing the support, mortgage backed securities rebounded to break above resistance and establish new ground at the 50 dma. This level will be watched closely to see if pricing can improve and bring us lower interest rates. (Remember that as the price of mortgage backed securities increase, the interest rates/yield will decrease).

What’s coming up this week on the economic calendar and what’s the impact on interest rates?

Most of the week will surround commentary, editorials, guesses, and opinions surrounding Fed Policy and direction. Does it make sense to take on further Fed stimulus by purchasing mortgage backed securities to boost the economy? The debate has been going on for years and the effects may linger for decades, but there is a strong likelihood that QE3 is coming. Fed Chairman Ben Bernanke will be delivering a speech on the Economic Outlook and Monetary Policy on Friday, possibly announcing QE3. If/When it happens, be prepared for massive market volatility.

The Bond markets will also battle a new $99 Billion in Treasury auction supply. As another long term, secure outlet for investors, these auctions can take away from buying of mortgage bonds but also acts as a litmus test for the Bond markets as a whole. $99B is a massive supply to unleash on the markets.

The economic calendar is full of reports this week but most should not have much of an impact on the Bond markets until Thursday’s Core PCE release. A popular measure of inflation, Core PCE should remain tame, but bonds and interest rates will almost always suffer if inflation starts to increase. File that away for now, but keep in mind for the coming months/years. Closing out the week will be the release of Chicago PMI, a manufacturing index to judge economic growth.

Here’s our strategy for the days and weeks ahead…

Interest rates have managed to find their way back to amazing levels and within a close range of historic lows. This rebound is a great opportunity for home seekers and home owners to think about locking in their interest rate. We’ve been shown again how volatile interest rates can be and see this rebound as an opportunity to capture what was lost. Sure, rates could move lower, but they could very easily move lower. Start a dialogue and relationship with someone that understands the market so you can take advantage of interest rate opportunities when they present themselves.

We maintain an ongoing dialogue with our clients about the market and interest rates throughout their financing experience so we can take advantage of the lowest rates when they present themselves. We all want the lowest rate, and the best way to ensure that you get the lowest rate, is to build a relationship with your mortgage planner, so they can best advise you on when to lock in your rate. Call us today for a complimentary mortgage review or Apply Online.