Current Interest Rates – Week of 7/30/12

Interest rates move fast as fears subside in Europe, helping boost stocks. Mortgage backed securities move from all time highs to their worst levels in 3 weeks as investors sell bonds to free up cash and take advantage of the positive global economic outlook.

What happened with interest rates last week?

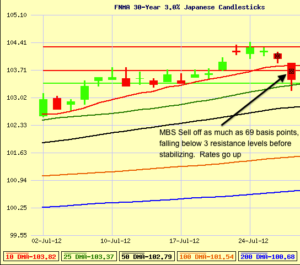

We started off last week’s report with interest rates at all time lows and the yield on the 10-Year Treasury Note at its lowest levels since the early 1800s, 1.39%. By the time the market closed on Friday, mortgage backed securities had reached their worst level in 3 weeks and the 10 yr. Yield had climbed to 1.54%. That is a massive swing in the market, with the majority of it coming in a 3-4 hour period on Friday.

Why the big swing? Before the market opened on Friday, rumors surfaced that the European Central Bank (ECB) would start buying debt of countries within the European Union (such as Italy, Spain, France…) to reduce the recent pressures on their yields/rates. We mentioned last week that the Spanish yield had climbed to 7.62%, but after investors factored in the potential purchasing of the ECB, the yield dropped down to 6.58%. The ECB purchasing these other bonds lets investors know that they’re not the only ones with skin in the game for the national debt of a country, thus driving down the required yield or required rate of return for the bonds of those countries being purchased.

The end result of this shift in market sentiment is for money to flow out of the safe haven of our US bonds (MBS, 10 yr. Treasury…) and into something that is paying a higher yield. This causes our mortgage backed securities to sell off, driving rates higher. The chart below will show the swing on Friday after the rumors were released.

When it comes down to it, investors can purchase a fixed rate of return from the US at a rate of 1.39% through a 10 yr. Treasury Note or they can go buy a fixed rate of return from the Spanish Treasury and get a 6.58% rate of return. It all comes down to investors having confidence that their yield will get paid and that there will be a market available to sell when the time is right. The spreads on these returns will normalize at some point, but in the mean time, look for investors to keep rolling the dice to find the sweet spot between a risk/reward relationship in bonds and treasuries.

What’s coming up this week on the economic calendar and what’s the impact on interest rates?

Following up a volatile trading week, mortgage backed securities and interest rates won’t have a chance to rest. The FOMC and ECB will be meeting this week with investors listening closely for any rumors and announcements. Since the FOMC and ECB have the ability to flex their muscle and announce how much firepower they’re willing to invest to help stabilize the markets, investors recognize this and will in many cases follow their direction. Rumors alone caused the market shift on Friday, so any news could be an important factor to help our clients secure the lowest interest rate.

Here’s our strategy for the days and weeks ahead…

As the 10-Yr. Note and mortgage backed securities took one of their largest hits in months, we are recommended that our clients closing in the coming days/weeks to lock in their interest rate now. We were fortunate to have our clients prepared for the market movement on Friday and were able to secure their interest rates before the market moved, savings them thousands of dollars over the life of their loan.

The opportunity to secure a historic low interest rate will come and go, so if you or your clients are closing in the coming weeks/months, we continue to recommend starting your pre-qualification process so that you can have a strategy in place for when interest rates make another run at historic lows. By beginning the process with your mortgage planner, they can be prepared to help you take advantage of these historic low mortgage rates next time the opportunity arises.

We maintain an ongoing dialogue with our clients about the market and interest rates throughout their financing experience so we can take advantage of the lowest rates when they present themselves. We all want the lowest rate, and the best way to ensure that you get the lowest rate, is to build a relationship with your mortgage planner, so they can best advise you on when to lock in your rate. Call us today for a complimentary mortgage review or Apply Online.