Current Interest Rates – Week of 9/24/12

Mortgage backed securities continue to paint the record books with the help of QE3 and the Fed’s attempt to further stimulate the economy. Find out why Robert Shiller from the Case/Shiller Home Price Index says that he feels that mortgage interest rates will not fall much further from their current levels. Is this the best rates are going to get?

What happened with interest rates last week?

Home loan interest rates managed to find their way back to all time lows last week as the Bond markets started their rally based on weak economic data out of Asia and Europe and the continued Bond buying from the Fed and the QE3 stimulus. The Fed is currently purchasing $40 billion of mortgage backed securities each month and could not have ho ped for better results in the first full week of the stimulus. Mortgage backed securities have risen by over 125 basis points, leading to our lowest interest rates ever. Aside from the weak economic data out of Asia and Europe, Initial Jobless Claims came in higher than expected at a number of 382,000.

ped for better results in the first full week of the stimulus. Mortgage backed securities have risen by over 125 basis points, leading to our lowest interest rates ever. Aside from the weak economic data out of Asia and Europe, Initial Jobless Claims came in higher than expected at a number of 382,000.

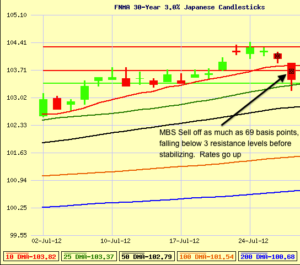

From a technical standpoint, we’re painting a new picture going forward. Mortgage backed securities have broken through all previous resistance levels established back on July 24th, 2012, our previous all time highs. As a result of breaking through resistance, these levels now will act as a floor of support, highlighting a new “worst case” pricing for home loans closing in the near term.

What’s coming up this week on the economic calendar and what’s the impact on interest rates?

The economic calendar is packed with releases this week. Starting on Tuesday with the Case-Shiller Home Price Index and Consumer Confidence, New Home Sales on Wednesday and Initial Jobless Claims on Thursday, the markets should continue their current trend leading into the big news on Friday. The Friday reports will start off with the Core Personal Consumption Expenditures, the Fed’s favorite gauge of inflation, which measures price changes in consumer goods and services after excluding food and energy components. Since inflation has a direct impact on interest rates, the report will be monitored to see if the year-over-year inflation figure has increased from its previous level of 1.6%. Also schedule for release on Friday is the Chicago PMI. Also known as the “Business Barometer”, the Chicago PMI is a manufacturing report indicating what may be to come in the ISM survey that will be released the following business day.

Here’s our strategy for the days and weeks ahead…

The stage is set for home loan rates to drop to the lowest levels we may see in our lifetime. Mortgage backed securities have broken through nearly all resistance levels, weak economic news continues to flow out of Europe and Asia, QE3 is in full swing. What more could we ask for?

Robert Schiller of the Case-Schiller Home Index expects that mortgage rates will not fall much further from their current levels. Here are a few reasons why:

- High Loan Volume = Higher Rates – The home purchase markets are continuing to gain traction as home prices stabilize and interest rates set historic lows. Throw in the numerous refinance programs available to current home owners and you’ll find lenders across the board are as busy as they have been in years. When loan volume increases and lenders start to reach capacity, they reach a breaking point. Beware of the bigger Banks like Wells Fargo, Chase, Bank of America, Citi, etc. Turn times are likely to get extended to a point that the applications are not able to close for 60-90+ days. As a result, their interest rates may be adjusted higher to slow down incoming applications. Smaller Banks and lending institutions (ie. Brazos National Bank) can avoid some of these issues with streamlined underwriting and closing processes.

- “G-Fee” – The “g-fee” or Guarantee fee has been implemented twice in the past 12 months and is a charge on all Fannie Mae and Freddie Mac home loans. The fee equates to roughly 75 basis points in price adjustment and is designed to raise revenues for Fannie/Freddie in an attempt to privatize the government sponsored entities. The previous “g-fee” was announced less than 3 weeks ago, and is now being followed by a third round of “g-fees”, targeting New York, Florida, Connecticut, New Jersey and Illinois. Follow the link to read FHFAs notice.

As the Guarantee fees mandated by FHFA continue to accrue and big Banks run at max capacity, the QE3 stimulus can only do so much to drive down home loan rates. A disconnect will start to form between the price of mortgage backed securities and the actual home loan interest rates that are offered to consumers.

Home loan rates have never been this low and may not stay this low for long. We are advising our clients to lock in their interest rate in the near term to take advantage of today’s low rates. In the longer term, we may see rates go lower, but there are too many other factors that can’t be solved by money printing (QE3), that are likely to send rates higher.

We maintain an ongoing dialogue with our clients about the market and interest rates throughout their financing experience so we can take advantage of the lowest rates when they present themselves. We all want the lowest rate, and the best way to ensure that you get the lowest rate, is to build a relationship with your mortgage planner, so they can best advise you on when to lock in your rate. Call us today for a complimentary mortgage review or Apply Online.

Current Interest Rates – Week of 9/17/12

The Fed launches into QE3 in a big way, targeting the purchase of $40 billion in Mortgage Backed Securities per month in an attempt to keep mortgage rates low and further stimulate the economy. Mortgage backed securities hit all time lows, but the news isn’t all good for home loan rates and the long term health of our economy.

What happened with interest rates last week?

The FOMC held their meeting last week and came to a majority decision that further stimulus was needed to help stimulate the economy. A topic of conversation for months, QE3 was launched targeting the purchase of $40 billion worth of Mortgage Backed Securities per month in an effort to “put downward pressure on longer-term interest rates, support mortgage markets and help to make broader financial conditions more accommodative.” On top of that, the Fed announced an extension of previous stimulus “Operation Twist”, which will push an extra $25 billion per month into the long term securities.

In the past, the FOMC has typically stated a term of how long the stimulus will continue. In this case the buying is open-ended, stating “the Committee will continue its purchase of agency mortgage-backed securities, undertake additional asset purchases, and employ its other policy tools as appropriate until such improvement is achieved in a context of price stability.” These actions may continue to keep rates low for the near term, but this money printing to manipulate our markets could have huge implications on the long term value of our dollar.

We’re not alone. The ECB announced their planned asset purchases of its suffering EU members two weeks ago. The concept is noble, the results are yet to be seen. One of two things will happen. Either the massive money printing and spending by global banks will cause a massive spike in inflation (which increases home loan rates), or the efforts to stimulate the economies will start to work by resulting in economic growth at a level that can sustain some sort of repayment of the accumulated stimulus debt.

Either way you look at it, the long term outlook for someone other than the Fed to purchase Mortgage Bonds for a return on investment is looking less attractive by the day. With mortgage rates and securities in the 3%-4% range, the added risk and inflationary pressure of QE3, investors may start looking elsewhere for a safe place to park their money.

What’s coming up this week on the economic calendar and what’s the impact on interest rates?

The launch of QE3 in such a massive scale and without a designated end date has set the stage for other central banks around the globe to consider doing some money printing of their own. Why not? The U.S. is doing it. If our open-ended QE3 sparks more global stimulus, the risk of inflation becomes even greater. Commodities like gold, oil, silver, etc. have already started to price in the long term inflation risks and will only continue to do so. Remember that inflation lowers the value of our dollar, providing less purchase power for our goods and services. This also applies to long term interest rates. Investors earned dollars are worth less, so they start requiring a higher rate of return and/or interest rate.

The economic calendar is light this week with the release of the Empire State Index this morning at its worst levels since 2009. The Philly Fed Index will be released on Thursday at 9 am CT and could create a catalyst for mortgage rates to move. The Philly Fed Index provides insight into manufacturing activites while also giving a sample of what may be reported in the ISM Index release.

Here’s our strategy for the days and weeks ahead…

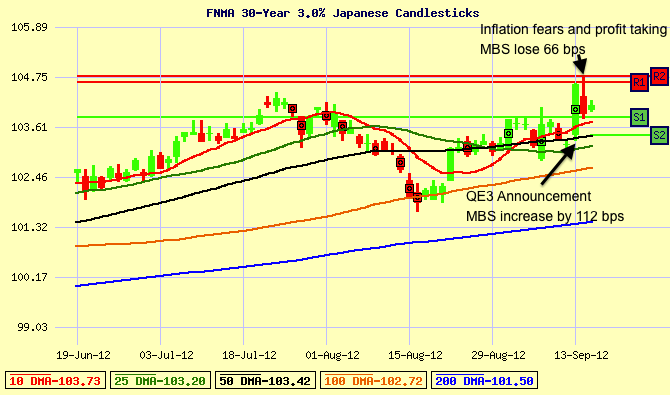

Home loan rates are lower as a result of QE3 being launched, but we feel like this may be as good as it gets for a while. When stimulus packages have been announced in the past, we have seen rates get better immediately following the announcements but saw steep rate increases in the weeks and months following. QE3 appears to be no different at the moment. Mortgage backed securities got to their best levels in history on the day of the announcement last Thursday. The following day saw a selloff of 66 basis points, driving interest rates back up by nearly .25%.

Home loan interest rates will continue to see volatility as global investors position themselves for a safe long-term investment. As the Fed adds another few hundred Billion to the balance sheet at a minimum, global investors may start to question how “safe” our long-term securities will be in the long run.

We maintain an ongoing dialogue with our clients about the market and interest rates throughout their financing experience so we can take advantage of the lowest rates when they present themselves. We all want the lowest rate, and the best way to ensure that you get the lowest rate, is to build a relationship with your mortgage planner, so they can best advise you on when to lock in your rate. Call us today for a complimentary mortgage review or Apply Online.

Current Mortgage Interest Rates – Week of 9/10/12

A roller coaster ride leaves interest rates at their best levels in over a month. A disappointing jobs report may be the final straw for the Fed to officially announce QE3 in their meeting this week. Find out how this impacts home loan interest rates.

What happened with interest rates last week?

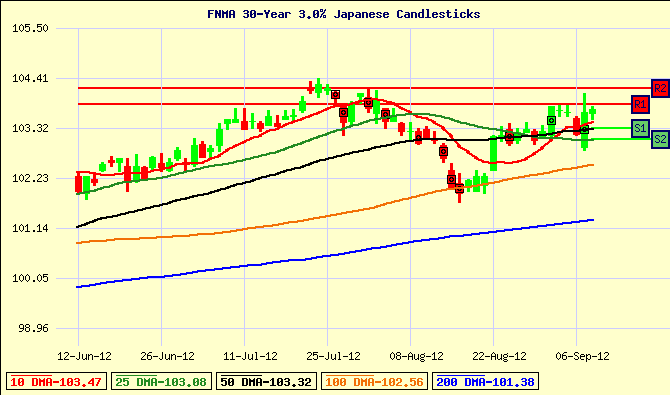

Interest rates in mortgage backed securities were on a wild ride last week and ended the week at the best levels in over a month. The majority of the volatility last week started with the ADP Employment report on Thursday. This report came in better than expected, sending stocks to multi-year highs and sent our mortgage backed securities beneath support at the 50 day moving average. While the ADP report is more of a picture of the private employment sector, the markets will often use this report as a glimpse of what may be to come in the Jobs Report that was released on Friday.

And for the Jobs Report? It was awful. Friday’s report was expected to announce 130,000 jobs created in August and the actual number was 96k. These large miss is a bad signal for the economy as a whole, which tends to drive investors into the safe haven of bonds like Mortgage Backed Securities (MBS). The result, MBS rallied as much as 120 basis points before closing up 75 bps. The big swing in price helps create a new trading range between the 50 day moving average and our recent highs set back in early August, roughly .125-.25% better than where we started the week.

What’s coming up this week on the economic calendar and what’s the impact on interest rates?

The markets could be quiet to start the week with no major announcements scheduled until Thursday with the minutes from the Fed Meeting (FOMC). As the meeting commences there will be $66 billion in Notes and Bonds auctioned this week. The auctions could provide some pressure on home loan interest rates and mortgage backed securities, but the markets around the globe will be waiting to see how the Fed responds to the disappointing jobs report and our current state of the economy.

The Fed has been hinting at the possibility of launching further economic stimulus, QE3, but has yet to make it official. However, top investment firms and analysts have placed a 50% chance that QE3 is announced this week. Many traders and investors have also seen this coming and have already started to factor in to stocks and bonds.

The question becomes, what impact does QE3 have on home mortgage rates, stocks, and other commodities? Even though QE3 is expected to target mortgage bonds to try and “stimulate” the economy, the spending increases our stimulus balance into the Trillions and is nothing but bad news for the US Dollar. We highlighted the potential impact of QE3 in our market update for the week of 6/4/12 and showed how Bonds have reacted to previous QE announcements. Each stimulus announcement, has seen a steep bond sell-off, causing our mortgage rates to go higher along with other commodities like Gold, Silver, Oil, etc. More printing/spending leads to our dollar becoming less valuable, requiring more dollars to purchase the same products, otherwise known as Inflation. Same goes for bonds and their interest rates. While the news is likely to be about how mortgage rates are being targeted to go lower, understand that inflation risk and low interest rates don’t mix.

Here’s our strategy for the days and weeks ahead…

The Jobs Report on Friday has more or less predestined the Fed to launch into further stimulus by way of QE3. Even though mortgage bonds are likely to be the target, we expect to see home loan interest rates go higher following the news. The markets will often take the stimulus news as a good sign immediately following the announcement, but the fact that it’s already been priced into the market and is a potential long term inflation risk, be prepared to lock in your interest rate after the news. In the mean time, we will be floating into the release of the Fed minutes on Thursday. Higher or lower, there is bound to be quite a bit of volatility this week allowing great opportunity for home buyers and home owners.

We maintain an ongoing dialogue with our clients about the market and interest rates throughout their financing experience so we can take advantage of the lowest rates when they present themselves. We all want the lowest rate, and the best way to ensure that you get the lowest rate, is to build a relationship with your mortgage planner, so they can best advise you on when to lock in your rate. Call us today for a complimentary mortgage review or Apply Online.

Current Interest Rates – Week of 9/4/12

Bernanke and the Fed are ready to launch QE3, targeting longer term securities. While this may help keep rates low, find out how increases to the “g-fee” charged by Fannie/Freddie will increase costs for consumers across the board.

What happened with interest rates last week?

Mortgage backed securities and interest rates finally broke out their tight trading range and are attempting to make a run towards historic low interest rates. Bernanke’s speech on the Economic Outlook and Monetary Policy in Jackson Hole, Wyoming was watched around the globe to see how the Fed may try to stimulate the economy. While further easing through QE3 was mentioned, it was yet to be announced. Nonetheless, even a mention caused stocks, bonds, gold, and oil to rally based on the strong likelihood that QE3 will be announced. It may come in the next Fed meeting held September 12-13th or they could continue to hold off. The purpose of QE3 is to stimulate the markets and just a rumor has already allowed them to accomplish their goal. Granted, it may not last long, but it allows the Fed more time to keep QE3 in their bag of tricks to stimulate the markets when the time is right. The market closed heading into the holiday weekend with a rally of over 50 basis points on Friday, closing at the best levels in over a month.

Other big news last week came from Fannie Mae and Freddie Mac as they begin to implement higher “g-fees” or guarantee fees on all of their loans. What’s a “g-fee”? Starting last year, Fannie and Freddie started to impose fees on all of their loans as a way to start to privatize some of the capital that backs their loans. Fannie/Freddie are largely backed by government capital through the Federal Housing Finance Agency (FHFA). Acting director, Edward Demarco said “These changes will move Fannie Mae and Freddie Mac pricing closer to the level one might expect to see if mortgage credit rrisk was borne solely by private capital.” Noble goal, but the “g-fees” are assessed to all Fannie/Freddie loans and will ultimately be incurred by our homeowners and we are far from seeing FHFA be replaced by private capital.

The key points to take from last weeks announcements are that even though the fundamental Bonds/securities that drive interest rates may be manipulated through Fed stimulus (QE3), there are other factors at play (g-fees) that are increasing the costs for home owners applying for a new mortgage loan. If rates decrease but costs increase, where does that put us? Possibly right where we started.

What’s coming up this week on the economic calendar and what’s the impact on interest rates?

The ISM Manufacturing Index was released this morning at the worst levels in over 3 years. The results have caused stocks to open the week lower and allowed Bonds and Mortgage Backed Securities to hold on to Friday’s gains.

On Thursday, the European Central Bank (ECB) is scheduled to deliver their rate policy going forward and will also discuss a rumored Bond buying program. The program would allow the ECB to purchase Bonds and help alleviate some of the risk of Bonds of the suffering countries. *Lookout ECB, we’ve tried this here. Please see paragraph above about FHFA and Fannie/Freddie.*

The big news this week comes with Friday’s Jobs Report. A signal for all markets, the Jobs Report can be a catalyst for big moves in stocks and Bonds. Thursday’s ADP Employment Report will provide some insight into what may be in store for the Jobs Report. Good Jobs numbers, look for stocks and the S&P to rally towards their multi-year highs around $1420. Bad Jobs numbers, stocks will suffer a further decline while mortgage backed securities and interest rates set the stage for another run at historic levels.

Here’s our strategy for the days and weeks ahead…

Bernanke’s speech in Jackson Hole on Friday brought a nice boost to mortgage backed securities and interest rates. We are currently recommended that our client closing in the coming days-weeks lock in their rate to secure the recent savings. We will be watching the news out of the ECB’s potential bond buying program. If this is seen to signal further risk for the economies in the EU, we could see our mortgage bonds become more of a safe haven, shifting our client strategy to float with the hope of lower rates to come leading into the Jobs Report. The market could see lots of volatility over the coming weeks and months. Be sure that you or your clients are in a relationship with a lender that understands and monitors the market closely.

We maintain an ongoing dialogue with our clients about the market and interest rates throughout their financing experience so we can take advantage of the lowest rates when they present themselves. We all want the lowest rate, and the best way to ensure that you get the lowest rate, is to build a relationship with your mortgage planner, so they can best advise you on when to lock in your rate. Call us today for a complimentary mortgage review or Apply Online.

Current Interest Rates – Week of 8/27/12

Continued volatility brings interest rates and stocks from recent highs. Fed hints at purchase of Mortgage Backed Securities to further stimulate the economy. Is QE3 coming?

What happened with interest rates last week?

After weeks of steep selling in the Bond markets, yields for mortgage interest rates and the U.S. 10 yr. Treasury have risen anywhere between .25%-.375%. That’s a huge swing if you’re a home buyer out shopping with your Real Estate agent. With mortgage backed securities flirting with support at the worst levels since March (100 day moving average) and stocks fighting resistance at multi-year highs, something had to give. Mortgage backed securities and interest rates bounced off their worst levels and managed to erase half of their losses in one trading day, establishing new support at the 50 day moving average. At the same time, the 10 yr. Treasury peaked at its 200 day moving average before starting to pull back. These resistance levels will now begin to establish a new trading pattern.

What happened? The economic news was light last week, but most of the volatility came after the Fed released its FOMC minutes and further hinted at the need further stimulus. The commentary at this point hints at the purchase of Mortgage Backed Securities to try and help keep rates low or possibly drive them lower. While much of QE3 has been priced into the market for the last few months, a final release and confirmation of the purchase plan will likely bring more volatility to the markets.

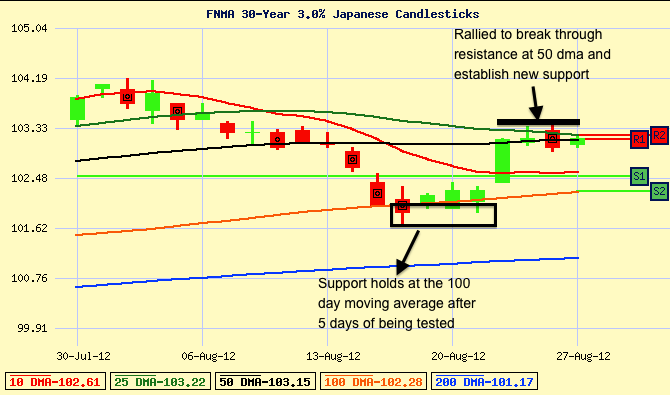

Last week we showed how mortgage backed securities had fallen through support at the 50 day moving average (dma) and were trying to hold support at the 100 dma. After testing the support, mortgage backed securities rebounded to break above resistance and establish new ground at the 50 dma. This level will be watched closely to see if pricing can improve and bring us lower interest rates. (Remember that as the price of mortgage backed securities increase, the interest rates/yield will decrease).

What’s coming up this week on the economic calendar and what’s the impact on interest rates?

Most of the week will surround commentary, editorials, guesses, and opinions surrounding Fed Policy and direction. Does it make sense to take on further Fed stimulus by purchasing mortgage backed securities to boost the economy? The debate has been going on for years and the effects may linger for decades, but there is a strong likelihood that QE3 is coming. Fed Chairman Ben Bernanke will be delivering a speech on the Economic Outlook and Monetary Policy on Friday, possibly announcing QE3. If/When it happens, be prepared for massive market volatility.

The Bond markets will also battle a new $99 Billion in Treasury auction supply. As another long term, secure outlet for investors, these auctions can take away from buying of mortgage bonds but also acts as a litmus test for the Bond markets as a whole. $99B is a massive supply to unleash on the markets.

The economic calendar is full of reports this week but most should not have much of an impact on the Bond markets until Thursday’s Core PCE release. A popular measure of inflation, Core PCE should remain tame, but bonds and interest rates will almost always suffer if inflation starts to increase. File that away for now, but keep in mind for the coming months/years. Closing out the week will be the release of Chicago PMI, a manufacturing index to judge economic growth.

Here’s our strategy for the days and weeks ahead…

Interest rates have managed to find their way back to amazing levels and within a close range of historic lows. This rebound is a great opportunity for home seekers and home owners to think about locking in their interest rate. We’ve been shown again how volatile interest rates can be and see this rebound as an opportunity to capture what was lost. Sure, rates could move lower, but they could very easily move lower. Start a dialogue and relationship with someone that understands the market so you can take advantage of interest rate opportunities when they present themselves.

We maintain an ongoing dialogue with our clients about the market and interest rates throughout their financing experience so we can take advantage of the lowest rates when they present themselves. We all want the lowest rate, and the best way to ensure that you get the lowest rate, is to build a relationship with your mortgage planner, so they can best advise you on when to lock in your rate. Call us today for a complimentary mortgage review or Apply Online.

Current Interest Rates – Week of 8/20/12

Signs of some economic growth push mortgage interest rates and treasury yields higher. Technical indicators have helped us guide our clients to lock ahead of the big market swings. Make sure you understand what technical signals will be driving rates going forward.

What happened with interest rates last week?

Mortgage backed securities and interest rates started the week clinging to resistance at the 50 day moving average. This support level had been tested for three consecutive trading days as the mortgage bonds dipped down to and even below that level, but managed to hold support at those levels. While the support levels were tested, we changed our guidance to let clients know that any move below the 50 day moving average would trigger an alert to lock. Low and behold, Retail Sales were released on Tuesday morning showing the largest gain since February and the first gain in 4 months. Stocks rallied and mortgage backed securities started to plummet as the support line at the 50 day moving average was breached, causing the mortgage bonds to face a 3 day sell-off of over 100 basis points, rates going up near .25%.

While these technical signals help guide our approach to mortgage backed securities and interest rates, we can learn similar trends on the stock and equity side of the market that help us better predict what may be coming on the bond side. Amidst the blood bath in the mortgage backed security market, the S&P 500 has rallied but seems to be running out of steam at 4 year highs and a resistance level of around $1420. Having attempted to break through these levels on two previous occasions, the S&P 500 now shows the forming of a “Triple Top”. This means that since the S&P 500 has reached these levels twice previously and has yet managed to break through the resistance, a third failed attempt would further establish this ceiling of resistance and could drive stocks lower in a hurry. Any movement in this direction should allow for funds to flow back into our bonds and mortgage backed securities.

The new support level for mortgage backed securities that we will be watching closely is one established by the 100 day moving average. This support level has managed to hold since March of this year. Having been tested four straight trading days, the support of the 100 day moving average seems to be holding strong, hopefully placing a short term cap on the rising interest rates in this volatile market.

What’s coming up this week on the economic calendar and what’s the impact on interest rates?

On the back of last week’s report heavy calendar, all eyes and ears will be on the FOMC minutes scheduled to be released on Tuesday August 21st at 1 pm CT. As usual, the markets will be waiting to hear if there is any mention of further quantitative easing. The Fed has plenty of data to analyze and support further easing, but will likely hold off until, maybe after elections?

Fundamentally, there is not a whole lot out there to say that interest rates should climb much higher. The Euro Crisis continues to erode the finances of the European Union with the ECB still being rumored to step in and help “cap” Bond yields by taking on some of the debt load. While our US economy has shown some signs of growth, the major components still seem to be lacking much progress. All the while, a negative political climate is blanketing the airwaves, highlighting the apparent flaws in any of our candidates. The end result of this kind of environment would typically sustain and promote lower interest rates, but how low do we expect them to go?

Here’s our strategy for the days and weeks ahead…

Mortgage backed securities have been in the midst of one of the largest sell offs in years, which says a lot given what our economy has been through in the last 5 years. A simple reminder to show you that the markets can move in an instant, and a worthy incentive to our clients to be in a relationship with a mortgage planner or lender that can help guide you through the process. The support at the 100 day moving average has shown strength and should help keep our interest rates from going much lower in the near future. Clients that are closing in the coming days-weeks, we are still recommending that they lock in their interest rate to take advantage of improved pricing from the end of last week. Clients closing in the coming weeks and months, we recommend to cautiously float. The 100 dma has held strong but with time on our side, we would like to see if any of the lost ground can be made up. In the event pricing deteriorates and falls below the 100 day moving average, we will immediately be shifting to a locking position. Things could get ugly fast.

We maintain an ongoing dialogue with our clients about the market and interest rates throughout their financing experience so we can take advantage of the lowest rates when they present themselves. We all want the lowest rate, and the best way to ensure that you get the lowest rate, is to build a relationship with your mortgage planner, so they can best advise you on when to lock in your rate. Call us today for a complimentary mortgage review or Apply Online.

Current Interest Rates – Week of 8/6/12

In another volatile week, interest rates see highs and lows based on a mixed bag of economic reports and commentary. After breaking through key support levels and rates still near historic lows, we urge potential prospects and clients to start creating a strategy to take advantage of the big swings in their potential interest rate for their home loan.

What happened with interest rates last week?

After seeing one of the worst trading days in months on Friday 7/27, mortgage backed securities and interest rates made up most of their ground by the time the market closed on Monday 7/30. Showing a clear example of how volatile interest rates can be. The choppy trading continued throughout the week.

The major catalysts leading to these swings came from commentary out of last week’s Federal Reserve monetary policy statement. While the Fed said that the economic activity had slowed over the first half of 2012, there were not yet any announcements of further stimulus or QE3.

On Friday, the market opened with an expected 100,000 new jobs created by employers in July. The actual figure came in far better than expected at 163,000, while the Unemployment rate for people still filing/receiving unemployment assistance increased to 8.3%. Investors saw this as a ray of hope and helped push stocks higher while our mortgage backed securities and interest rates suffered, falling below a key level of support for the first time since March. Another reminder to be proactive with your home financing, whether purchasing or refinancing.

What’s coming up this week on the economic calendar and what’s the impact on interest rates?

After the rough trading day on Friday, mortgage bonds are trying to shake off some of the losses and stage a rally to open the trading week. After falling below the key support at the 25 day moving average, we will be watching to see if mortgage backed securities can close above the resistance level and start to establish a new trend towards historic lows.

There is not much economic data scheduled for release this week but investors will be watching to see how the Bond market handles an auction of $72 billion in auctions. This is where the market gets tested. Are our bonds still the safest haven for global investors looking to minimize risk? We’ll know by the end of the week.

Here’s our strategy for the days and weeks ahead…

Mortgage backed securities and interest rates have been extremely volatile over the last few weeks, showing glimpses of market uncertainty that we’ve faced throughout this financial crisis. With so many outside influences affecting the direction of interest rates, it is important to identify a trading range so we can have a better opportunity to secure the lowest interest rates when the opportunity arises.

Mortgage backed securities closing below the 25 day moving average for the first time since March could change the market sentiment and lead interest rates higher. Until bonds stabilize above this level, we will be recommending that our clients lock in their interest rates in the near and short term to take advantage of near historic lows. Should the market move to new historic lows after a rate lock, our team has the ability to renegotiate your interest rate with our lenders, providing a win win situation in this volatile and uncertain market.

We maintain an ongoing dialogue with our clients about the market and interest rates throughout their financing experience so we can take advantage of the lowest rates when they present themselves. We all want the lowest rate, and the best way to ensure that you get the lowest rate, is to build a relationship with your mortgage planner, so they can best advise you on when to lock in your rate. Call us today for a complimentary mortgage review or Apply Online.

Current Interest Rates – Week of 7/30/12

Interest rates move fast as fears subside in Europe, helping boost stocks. Mortgage backed securities move from all time highs to their worst levels in 3 weeks as investors sell bonds to free up cash and take advantage of the positive global economic outlook.

What happened with interest rates last week?

We started off last week’s report with interest rates at all time lows and the yield on the 10-Year Treasury Note at its lowest levels since the early 1800s, 1.39%. By the time the market closed on Friday, mortgage backed securities had reached their worst level in 3 weeks and the 10 yr. Yield had climbed to 1.54%. That is a massive swing in the market, with the majority of it coming in a 3-4 hour period on Friday.

Why the big swing? Before the market opened on Friday, rumors surfaced that the European Central Bank (ECB) would start buying debt of countries within the European Union (such as Italy, Spain, France…) to reduce the recent pressures on their yields/rates. We mentioned last week that the Spanish yield had climbed to 7.62%, but after investors factored in the potential purchasing of the ECB, the yield dropped down to 6.58%. The ECB purchasing these other bonds lets investors know that they’re not the only ones with skin in the game for the national debt of a country, thus driving down the required yield or required rate of return for the bonds of those countries being purchased.

The end result of this shift in market sentiment is for money to flow out of the safe haven of our US bonds (MBS, 10 yr. Treasury…) and into something that is paying a higher yield. This causes our mortgage backed securities to sell off, driving rates higher. The chart below will show the swing on Friday after the rumors were released.

When it comes down to it, investors can purchase a fixed rate of return from the US at a rate of 1.39% through a 10 yr. Treasury Note or they can go buy a fixed rate of return from the Spanish Treasury and get a 6.58% rate of return. It all comes down to investors having confidence that their yield will get paid and that there will be a market available to sell when the time is right. The spreads on these returns will normalize at some point, but in the mean time, look for investors to keep rolling the dice to find the sweet spot between a risk/reward relationship in bonds and treasuries.

What’s coming up this week on the economic calendar and what’s the impact on interest rates?

Following up a volatile trading week, mortgage backed securities and interest rates won’t have a chance to rest. The FOMC and ECB will be meeting this week with investors listening closely for any rumors and announcements. Since the FOMC and ECB have the ability to flex their muscle and announce how much firepower they’re willing to invest to help stabilize the markets, investors recognize this and will in many cases follow their direction. Rumors alone caused the market shift on Friday, so any news could be an important factor to help our clients secure the lowest interest rate.

Here’s our strategy for the days and weeks ahead…

As the 10-Yr. Note and mortgage backed securities took one of their largest hits in months, we are recommended that our clients closing in the coming days/weeks to lock in their interest rate now. We were fortunate to have our clients prepared for the market movement on Friday and were able to secure their interest rates before the market moved, savings them thousands of dollars over the life of their loan.

The opportunity to secure a historic low interest rate will come and go, so if you or your clients are closing in the coming weeks/months, we continue to recommend starting your pre-qualification process so that you can have a strategy in place for when interest rates make another run at historic lows. By beginning the process with your mortgage planner, they can be prepared to help you take advantage of these historic low mortgage rates next time the opportunity arises.

We maintain an ongoing dialogue with our clients about the market and interest rates throughout their financing experience so we can take advantage of the lowest rates when they present themselves. We all want the lowest rate, and the best way to ensure that you get the lowest rate, is to build a relationship with your mortgage planner, so they can best advise you on when to lock in your rate. Call us today for a complimentary mortgage review or Apply Online.

Current Interest Rates – Week of 7/9/12

Poor jobs report and bleak painting of future job growth lead home loan interest rates to all time lows. Sets the stage for best home buying and home refinance opportunities ever.

What happened with interest rates last week?

Interest rates moved a leg lower to set new all time lows for potential home buyers and homeowners. The Jobs Report was released last Friday showing that only 80,000 jobs were created in June, well below the 100,000 that were expected.

These gloomy reports, in combination with a stalling global economy, create uncertainty for stock and equity markets. The end result, money flows from those stocks and equities into the safe haven of bonds and mortgage backed securities, causing interest rates/yields to drop to record lows.

What’s coming up this week on the economic calendar and what’s the impact on interest rates?

Following the poor Jobs report here on the mainland, China and Japan released worse than expected economic data to start our trading week. While mortgage backed securities and bonds are trading at unprecedented levels, these lows could be affected by $66 billion in notes and bonds that will be auctioned this week.

The lackluster reports have also started to revive the talks of QE3 with the markets placing a 75% chance that further stimulus will be unveiled. Let the banter between Fed members begin and expect it to continue until the next Fed meeting in August.

Here’s our strategy for the days and weeks ahead…

Home loan interest rates continue to ride the wave of the US and global markets and as these markets continue to plunge, our home financing rates are doing the same. The advice to our clients closing in the days/weeks ahead would be to lock in your rate today, literally sitting at the best levels ever. Rates could continue to move lower, but our signals point to rates going back up to more “normal level” before they push lower in a longer time frame.

The chart below shows mortgage backed securities breaking through all previous resistance levels into historic and untested territory. With no real trading/technical data available at these levels, new resistance and support is being created daily/hourly. Resistance and support will become stronger as the levels are tested over time.

We maintain an ongoing dialogue with our clients about the market and interest rates throughout their financing experience so we can take advantage of the lowest rates when they present themselves. We all want the lowest rate, and the best way to ensure that you get the lowest rate, is to build a relationship with your mortgage planner, so they can best advise you on when to lock in your rate. Call us today for a complimentary mortgage review or Apply Online.

Current Interest Rates – Week of 6/25/12

Home loan interest rates, home affordability, and low inventory set the stage for homeowners and home buyers to save thousands. Whether refinancing, moving up, or financing your first home, now is the time to create your real estate strategy and put a plan in place.

What happened with interest rates last week?

The Fed held their quarterly meeting last Tuesday and Wednesday, with stimulus and the possibility of QE3 being announced. The result, extend the current stimulus program “Operation Twist”, allowing the possibility of QE3 in the future. Interest rates took cues from stocks as investors used the announcement as an opportunity to make a quick buck in stocks, causing a brief sell-off in mortgage backed securities, causing home loan rates to increase. Fortunately for interest rates, the stock rally was brief and home loan rates found their way back to levels where they opened the week, poised to make a run at setting/meeting historic lows.

What’s coming up this week on the economic calendar and what’s the impact on interest rates?

Following a week full of anticipated announcements from the Fed, the only scheduled economic reports due this week will be on Friday 6/29 with the release of Core PCE, a popular measure of inflation that excludes food and energy costs. The previous release was at 1.9%, within the Fed’s target range of 1.7-2.0%. While not expected, a release above the target range could cause interest rates to go up. The Chicago PMI, aka “Business Barometer” is also due for release on Friday. Signs of business growth would be good for stocks and bad for rates. Signs of slowing/stagnant business growth would be bad for stocks and good for the safe haven of bonds/interest rates.

The elephant in the room would be the pending release of the Supreme Court’s ruling on the the Affordable Health Care Act. While seemingly unrelated to interest rates or home purchase financing, the ruling will have a great impact on corporations down to small businesses as their plans for growth may be dependent on their required health care plans and/or contributions. With no set date/time for the release of the ruling, it is expected at the end of the week and could be a big factor in market movement once the news hits the wire.

Here’s our strategy for the days and weeks ahead…

Interest rates are trading in a tight range attempting to break out to test the historic lows reached on June 1st. Since mortgage backed securities have never closed above this level, it now acts as a ceiling of resistance that will likely take some sort of catalyst in the market to break through. The good news is, the catalyst could come from any of the following likely sources: further Euro meltdown, Supreme Court ruling on Affordable Healthcare Act, poor economic releases…

The key is to know where you stand with your current home financing in relation to what’s available in today’s low interest rate environment. While rates are likely to remain low, waiting a year to refinance at the same rate available today, would end up costing you thousands of dollars. On a similar note, if you’re buying a home in Dallas, the prices are likely to be higher next year, causing less affordability and the potential of a higher monthly payment than you would have today.

The bottom line is know where you stand in relation to where you would like to be, whether that’s in the same home with a lower payment or in the new home of your dreams. The opportunities available to homeowners are amazing.

We maintain an ongoing dialogue with our clients about the market and interest rates throughout their financing experience so we can take advantage of the lowest rates when they present themselves. We all want the lowest rate, and the best way to ensure that you get the lowest rate, is to build a relationship with your mortgage planner, so they can best advise you on when to lock in your rate. Call us today for a complimentary mortgage review or Apply Online.